[Editor’s note: this article is reprinted from David Stockman’s ContraCorner, which offers such analysis daily to subscribers. Pound-for-pound, Stockman’s daily analysis is the most comprehensive, salient, insightful, and data-rich of anything available today. His decades of experience in both finance and policy, and his principled and legendary commitment to revealing the unvarnished truth and demonstrating his claims with data, is daily on display. Brownstone is proud that Stockman also serves as a senior scholar, and he graciously permits periodic republishing here.]

Who said Joe Biden isn’t in touch with main street America?

An analysis by the University of Pennsylvania found that his proposed three-month gas tax suspension would save Americans an average of, wait for it, $5 to $14!

Still, he’s relentless.

“For all Republicans criticizing me for high gas prices in America, are you nowsaying we were wrong to support Ukraine and stand up to Putin? Are you saying that we’d rather have lower gas prices in America than Putin’s iron fist in Europe?”

Well, yes we are!

Putin’s quarrel is with Ukraine, not Europe, and the former is none of our business. Indeed, the word “Ukraine” means borderlands in Russian, and the struggle to establish borders and sovereignty there has been going on for 1300 years.

So Americans getting financially impaled at the gas pump on account of Joe Biden’s Sanctions War against Putin has nothing whatsoever to do with homeland security and liberty.

As Bill King aptly retorted this AM,

“It is a tale.Told by an idiot, full of sound and fury, Signifying nothing.”

Then again, desperation is as desperation does. A new QuinnipiacPoll shows Biden’s Approval rating has plummeted still further:

- Overall: Approve 33%, Disapprove 57%;

- Hispanics: Approve 29%, Disapprove 53%.

So the prospect of more random manipulation of market function is high and rising. The latest gambit, apparently, is potential use of the Economic Stabilization Fund (ESF) authorities and resources to insure oil companies against a downside crash of prices and to fund incremental production.

That’s right. Last week they threatened to administer a severe beating to Big Oil via a windfall profits tax after 18 months of nonstop anti-fossil fuels regulatory action and rhetorical hysteria about Climate Change.

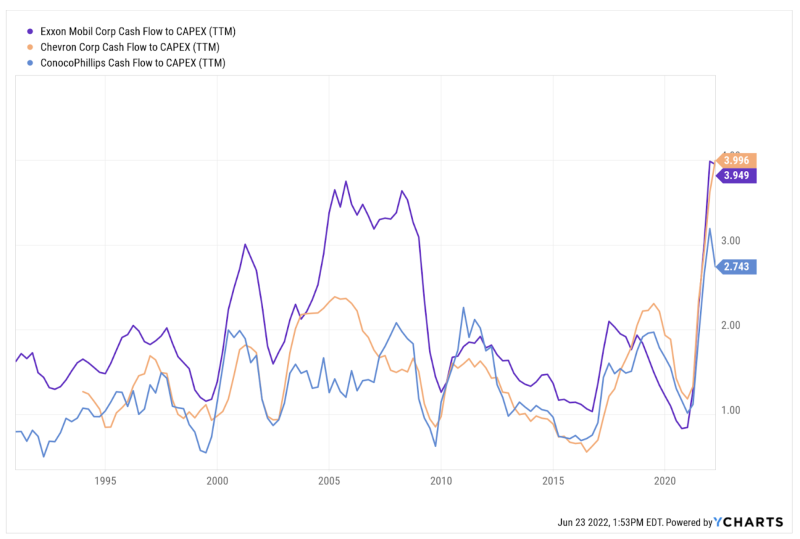

Now, out of desperation, White House insiders are talking oil company bailouts. Is it any wonder, therefore, that energy industry executives have become frozen like deer in the headlights: They are deathly afraid of offending the Climate Change fanatics who dominate both Washington and Wall Street, even as they cut CapEx to the bone out of prudential concern about the Green Energy policy onslaught.

In fact, the ratio of operating cash flow to CapEx for the US majors is at an all-time high, meaning that use of available cash flow for investment is at an all-time low.

That is to say, sky-high petroleum prices are not inducing a normal investment response. Instead, normal market signals for investment are being nullified by anti-fossil fuels messages emanating from both ends of the Acela Corridor.

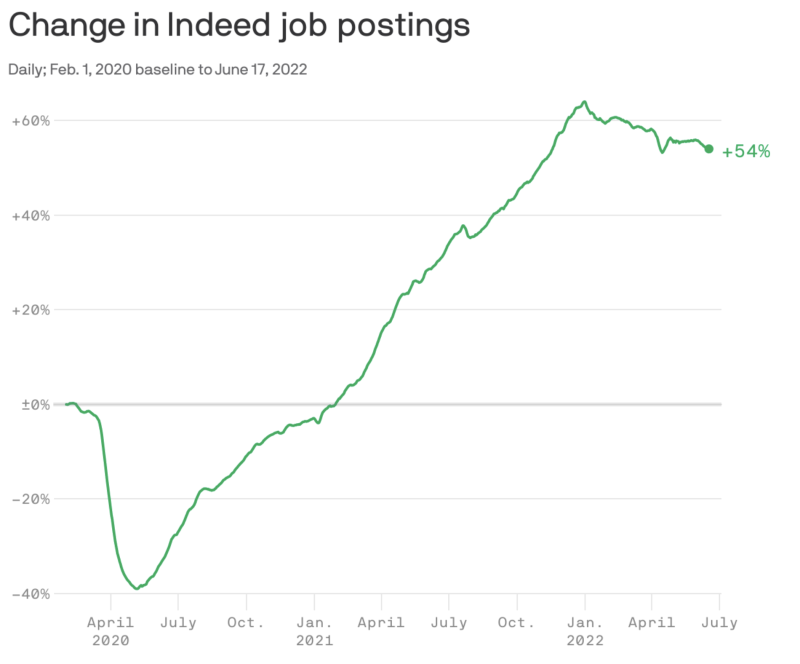

In any event, the US economy has suffered all the dislocations and yo-yoing that it can stand. Consider the chart below from a leading job placement firm. After plunging by 40% versus the pre-Covid baseline when the Virus Patrol shutdown the economy in April 2020, job postings then exploded higher, reaching +60% by January 2022.

Yet this was not a sign of a robust economy. It was evidence of worker hoarding by big companies who apparently thought the consumer spending boom fueled by $6 trillion of stimmies would last forever. We’d place high odds, therefore, on the likelihood that the green line below will head sharply south in the months ahead as the Fed’s belated tightening campaigned gathers force.In fact, cracks in the jobs market are already becoming evident. As the Wall Street Journal recently described it:

Companies including Twitter Inc. , real-estate brokerage Redfin Corp. , and cryptocurrency exchange Coinbase Global Inc. have rescinded offers in recent weeks. Employers in other pockets of the economy are pulling away offers too, including some in insurance, retail marketing, consulting and recruiting services.

At the same time, many companies have signaled a more cautious hiring approach. Netflix Inc. , Peloton Interactive Inc. , Carvana Co. and others announced layoffs. Technology giants such as Facebook parent Meta Platforms Inc. and Uber Technologies warned they will dial back hiring plans.

He said having a job offer rescinded was almost unheard of six months ago. “If we’ve learned anything from the last couple of years, it’s that things can change quickly.”

Likewise, if the lesson had to be learned, it has also become evident that Washington’s relentless “Sanctions Wars” have been an economic disaster for the American public. After all, one of the major reasons oil prices are sky-high is that Washington has imposed oil export sanctions on three of the biggest oil producers on the globe—Venezuela, Iran and Russia.

Prior to the forced cutback of their exports, the three produced upwards of 18 million barrels per day (mb/d) or nearly 20% of global supply. That’s now down by 30% to 12.5 mb/d and threatens to go lower under Washington’s savage attacks on would be buyers of oil from these three major producers, whose foreign policies do not bend to Washington’s dictates.

But ironically, even those heavy handed export bans have partially boomeranged. That is, Russia sells its crude oil to China and India where it gets refined. Some of the resulting gasoline and diesel is then exported back to the U.S.

Of course, that’s good for India and China as they buy the Russian crude oil at a deep discount and then sell the refined products at a substantial premium. So it’s is a ‘win’ ‘win’ ‘win’ for Russia, India and China with the sole loser being the ‘west’ and most especially American consumers.

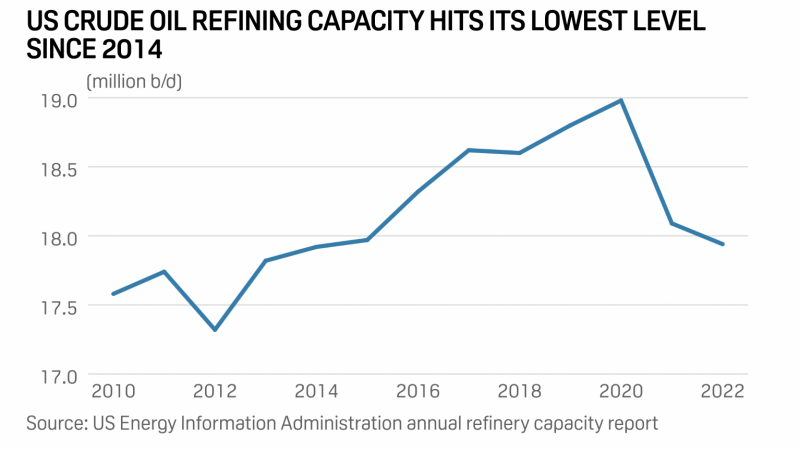

Were the Sanctions War the extent of Washington’s energy policy follies, the impact would be bad enough. But owing to the Biden’s Green Energy crusade, operable refining capacity in the United States hit a nearly decade low in 2022, the EIA’s latest Refining Capacity Report showed on Tuesday.

U.S. refining capacity fell this year to 17.94 million barrels per day as of January 1, according to the latest EIA data. That’s down from 18.09 million b/d on January 1st last year and 18.8 million b/d in 2019. In fact, U.S. refining capacity is now the lowest it’s been since 2014.

Overall, North America has lost close to 1.3 million b/d in refining capacity in the last three years, including more than 600,000 b/d in Louisiana. Within Louisiana, the 255,600 b/d Phillips 66 Alliance Refinery, the 211,146 b/d Shell Convent Refinery and the 135,500 b/d Calcasieu Refining complex have all closed since the beginning of 2020.

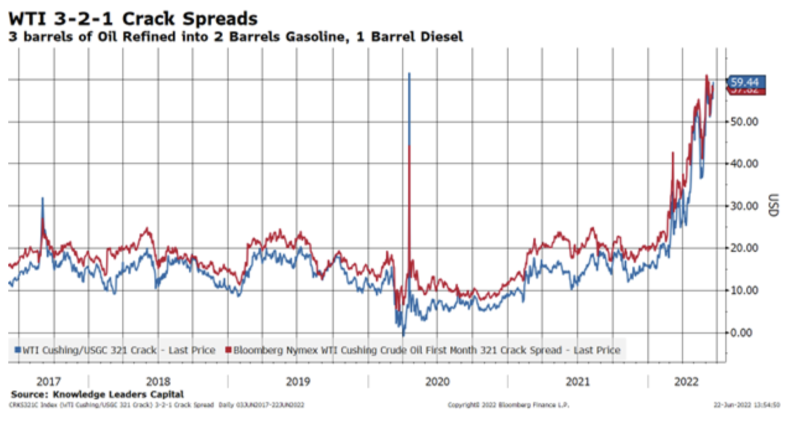

It is no wonder, therefore, that crack spreads—the difference in cost between the crude barrel coming into the refinery and the slate of products going out—are at an out of this world high of nearly $60 per barrel versus a normal recent level of $10-$20 per barrel.

That is, it’s not just a global shortage of crude supplies, but the double whammy at the refineries which has driven gasoline above $5 per gallon and diesel above $6 per gallon.

Of course, the hegemonists on the banks of the Potomac River are never done when it comes to interfering in the internal governance of countries all over the planet, imposing sanctions at the drop of the hat.

So notwithstanding high inflation caused by a lack of supplies Washington this week launched what amounts to the dumbest sanctions regime ever. This time against China owing to its alleged mistreatment of its minority Uyghur population.

A new law called the Uyghur Forced Labor Prevention Act (UFLPA) goes into effect this week and will bar products that were made in Xinjiang or have any ties whatsoever to the work programs there from entering the US. It requires importers with any ties to Xinjiang to produce documentation showing that their products, and every raw material they are made with, are free of forced labor — a tricky undertaking given the complexity and opacity of Chinese supply chains.

In effect, the new U.S. law will block all China-sourced goods made with any raw materials that are associated with Xinjiang until they are proven to be free of slavery or coercive labor practices.

As it happens, however, many commodities like lithium and nickel are produced in Xinjiang and flow into numerous downstream products. For instance, Xinjiang Nonferrous and its subsidiaries have partnered with the Chinese authorities to take in hundreds of Uyghur workers in recent years.

These workers were eventually sent to work in the conglomerate’s mines, a smelter and factories that produce some of the most highly sought minerals on earth, including lithium, nickel, manganese, beryllium, copper and gold. While it is obviously nigh impossible to trace precisely where the metals produced by Xinjiang Nonferrous go, some have been exported to the United States, Germany, the United Kingdom, Japan, South Korea and India, according to company statements and customs records.

And some have gone to large Chinese battery makers, who in turn, directly or indirectly, supply major American entities, including automakers, energy companies and the U.S. military, according to Chinese news reports.

Needless to say, these new sanctions can go far afield. For instance, Washington issued new guidelines this last week that will surely clobber the solar industry that is supposed to replace the missing fossil fuels. That’s because the guidelines include a section on polysilicon imports.

In order to comply with the UFLPA, solar companies must:

- Provide complete supply chain documentation that lists all entities involved in the exported good.

- Provide a flow chart mapping each step in production and identify the region where each material originated.

- Provide a list of all entities associated with each step of production, even if the exporting company did not directly work with them.

The guidelines also state that solar companies that source polysilicon both from within Xinjiang and outside the region risk being subject to detention, as it may be more difficult to verify the products did not co-mingle with Xinjiang polysilicon at any point in the manufacturing process.

So more yo-yoing of the supplies and prices of China goods is surely coming down the pike. Meanwhile, the boom in US retail has suddenly cooled dramatically.

Thus, according to Bloomberg, retail foot traffic fell 4.9% in the most recent week, marking the fifth straight weekly decline. Within retail overall, home improvement store traffic dropped 16.6% and malls, department stores and apparel traffic fell by 12.7%.

Among individual chains, Best Buy suffered a 58.2% plunge while Victoria’s Secret experienced a decrease of 47.4%. Again, these are not normal, minor commercial fluctuations—they are part of the government induced whip-saw that is rampaging through the American economy.

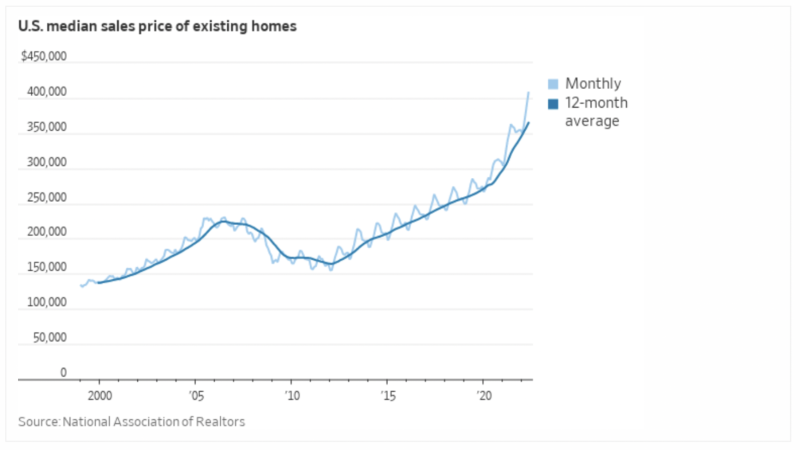

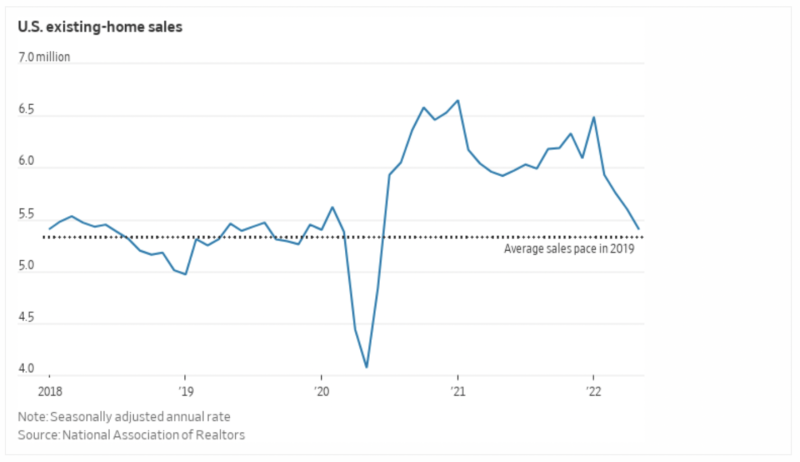

Similarly, the relentless climb in U.S. home values continued in May, when median prices shot up by 15% to a record $407,600, while the actual volume of sales fell owing to pressures from high and rising mortgage rates.

In fact, compared to the red hot housing market induced in 2021 by the Fed drastic interest rate repression and money-pumping, existing homes sales volume has already dropped by nearly 20% and has a long way yet to go—even as housing prices finally rollover under the pressure of plunging volumes.

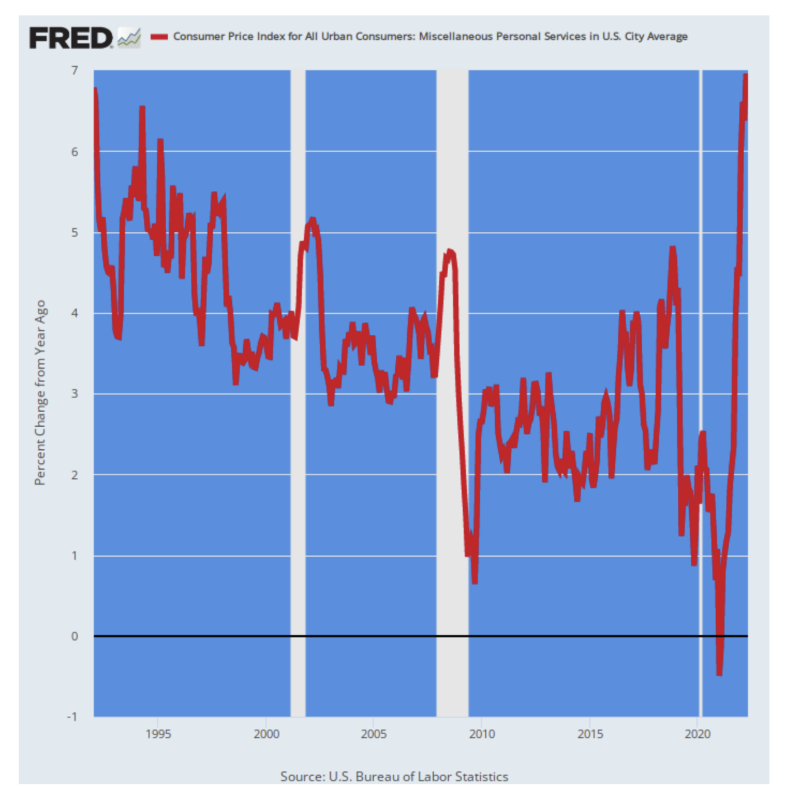

Finally, apparently nothing is escaping the volume and price yo-yo. Even haircuts are now up by 6.6% versus prior year, while related personal services overall are now pushing a 7.0% gain.

Once upon a time there was a joke about “I’m from Washington and I’m here to help you”.

That’s now a reality and it’s no joke.

Y/Y Change In Personal Services CPI, 1994-2022

Published under a Creative Commons Attribution 4.0 International License

For reprints, please set the canonical link back to the original Brownstone Institute Article and Author.