Oh, c’mon!

They have done it again, and in a way that makes a flaming mockery of both honest market economics and the so-called rule of law. In effect, the triumvirate of fools at the Fed, Treasury, and FDIC have essentially guaranteed $9 trillion of uninsured bank deposits with no legislative mandate and no capital to make these sweeping promises good.

In the case of the direct bailout of all depositors at SVB and Signature Bank, these closed institutions have now been ridiculously christened on a postmortem basis as “SIFIs” (systematically important financial institutions). That makes them eligible for a hidden backdoor bailout mechanism in the 2009 Dodd-Frank Act, which gave authorities the power to guarantee any and all bank deposits above the standard $250,000 limit.

You might say “who knew” our brilliant legislators deemed public guarantees of the deposits of giant hedge funds and Fortune 500 companies, among like and similar “deserving” others, to be an essential “reform” warranted by the lessons of 2008?

Then again, we will just note the hideous abuse of language implicit in this weekend’s maneuver. Total assets of the US banking system amounted to $30.4 trillion at the end of 2021. Accordingly, the $110 billion of assets at Signature bank amount to 0.36 percent of the total and SVB’s assets of $210 billion were just 0.70 percent of the banking system’s assets.

If these sub-1% entities are indeed “systematically important,” then riddle us this: Why were these cesspools of reckless banking not declared to be SIFIs back in 2011 along with JP Morgan ($3.7 trillion of assets), Bank of America ($4.1 trillion of assets), and the rest of the two dozen SIFI big boys, who at least had to adhere to enhanced capital and liquidity standards in return for getting the SIFI trophy?

Indeed, notwithstanding all the Mickey Mouse aspects of the SIFI capital standards regime, it might well be wondered whether Signature and SVB would still be open today had they needed to adhere to JP Morgan levels of capital and liquidity, but one thing is certain: Getting the benefits of a posthumous SIFI designation that they were never required to adhere to while they were still among the living is a new low in Washington servility to the powerful. In this case, the billionaire overlords of Silicon Valley and the VC racket whose deposits were at risk until about 6PM Sunday night.

And yet, and yet. The grotesque bailout of the large depositors who wear the Big Boy Pants at these institutions is just the tip-of-the-iceberg of the outrage warranted by this weekend’s pitiful capitulation.

It apparently became evident even to the brain-dead zombies who run the triumvirate in Washington that bailing out all SVB and Signature Bank depositors would trigger a massive run on deposits at other “small” banks—and for that matter most any non-SIFI institution. So they extended the bailout to the entire $18 billion universe of US bank deposits, more than $9 trillion of which are not covered by the existing $250,000 FDIC insurance limit.

And pray tell what lighting enactment of a Congress which was not even in session over the weekend, or prior enactment that no one on earth ever heard of, was this sweeping commitment of taxpayer funds based on?

The true answer is essentially institutional arrogance. Technically, the new Bank Term Funding Program (BTFP) was invoked under the Fed’s emergency authorities to handle “unusual and exigent circumstances” by cranking up its printing presses. But this new addition to the alphabet soup of facilities first stood up during the 2008-2009 crisis is just plain over the top.

It will allow banks to borrow 100 cents on the dollar against the book or par value of trillions of UST and Agency debt on their balance sheets. Yet much of it is massively underwater owing to the fact that at long last the yields on fixed income securities are being allowed to normalize. And unlike normal free market practice, BTFP users won’t even have to over-collaterize their loans.

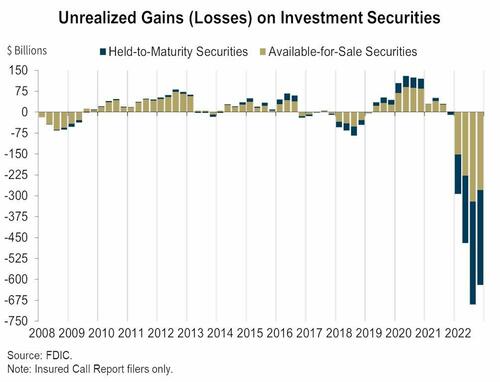

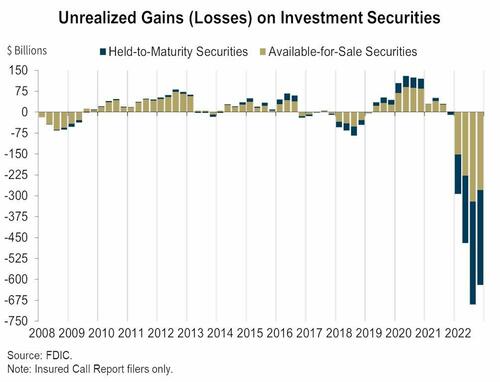

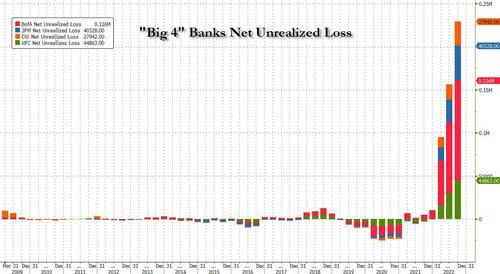

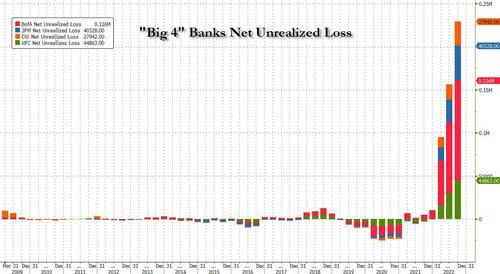

Accordingly, this is a huge gift to banks which were sitting on some $620 billion in unrealized losses on all securities (both Available for Sale and Held to Maturity) at the end of last year, according to the Federal Deposit Insurance Corp. It also means that just the Big 4 banks—as shown in the second chart below—are getting a $210 billion bailout.

Needless to say, this whole deal reeks of hypocrisy, incompetence and lies. As QTR said this AM:

The Fed is fighting panic with more panic. At a time when Chair Jerome Powell aimed to crush inflation and posture as though nothing could change the Fed’s policy, he has crumpled like a cheap suit as the first losses (of many to come) take place in the world’s frothiest and most deserving garbage assets. Silicon Valley Bank was literally the tip of the spear of malinvestment, and the Fed is acting like J.P. Morgan is at risk.

In this context we might as well start with Janet Yellen, who always seems to be hanging around the basket when the bleeding heart liberal Keynesians decide it’s time to bail out the big boys for the purported benefit of the regular people. Thus, on the midday talk shows yesterday she was vowing that with respect to bailouts, “We are not doing that again”.

Yet six hours later she did exactly that. Again.

So about the only thing you can say about this mutton-head is that just maybe she has the attention span of our 3-year-old grandson!

But what is really galling is the pathetic double-talk already coming out of Washington. For example, the claim it won’t cost taxpayers a dime is complete nonsense. The FDIC has the authority to raise insurance premiums sky-high on the whole enchilada of the public’s money—-the aforementioned $18 trillion of deposits.

So that’s a tax, folks!

Likewise, the shareholders of these deceased banks are not being bailed out, it is claimed. Well, there is nothing new about that—neither were the old shareholders of Lehman, Bear Stearns, and WaMu back in 2008-2009.

But that has never been the problem. The problem is socializing risk because it leads to reckless behavior in the future. And now in its wisdom Washington has taken the risk of deposit flight off the table entirely for the entire US banking system.

This means, in effect, that the Fed’s Dodd-Frank license to the 30 SIFI institutions to counterfeit “profits” has now been extended to more than 5,000 US financial institutions.

And we do mean license to counterfeit net income. For instance, because JP Morgan’s uninsured deposits have been effectively guaranteed by the SIFI scheme, its average cost of deposits as of FY 2022 was—wait for it—slightly under 1.0 percent!

That is to say, between the Fed’s massive repression of interest rates and the SIFI socialization of deposit risk to SIFI customers, JPM has minted $258 billion of net income during just the past eight years. Of course, when the cost of production is nigh on to zero, it doesn’t even take a purported genius like Jamie Dimon to generate a tsunami of net margin, net income, and soaring stock option profits to top executives.

Stated differently, trainwrecks like SVB are not an aberration. They are the expected outcome (eventually) when depositors have no concern about the dangerous yield curve and credit risk arbitrages that are played by bank managements on the asset side of the ledger.

Indeed, there is no hope for free market discipline and stability in financial institutions until depositors are put fully at risk for losses. And as far as we are concerned, that even includes the blue-haired ladies supposedly protected by the once and former $250,000 insurance limit.

In short, if you want to blow up the banking system, all the so-called “prudential regulation” in the world will not make a whit of difference, as we learned over the weekend, if depositors are asleep at the switch or euthanized by the everlasting moral hazard implicit in the socialization of risk to depositors.

And if you then make socialized deposits dirt cheap by running the central bank’s printing presses red hot for years on end, it’s an invitation to every fly-by-night financial schemer and empty suit across the land to grow bank balance sheets like Topsy and print ill-gotten profits off the back of crooked deposits.

For want of doubt, just know this. A member of the board of Signature Bank, which went belly-up on Sunday, was Mr. Prudential Regulation himself, former Congressman Barney Frank. This genius wrote the law to end all bank crises and failures but apparently didn’t see one mushrooming right under his own nose.

We will address that matter with respect to the current banks in crisis in Part 2, but suffice it here to take note of the most hideous statement of the day—-this one from Sleepy Joe.

“I’m firmly committed to holding those responsible for this mess fully accountable.”

Well, in that case the 12 fools who comprise the FOMC had better lawyer up because this whole mess begins and flourishes on their systematic destruction of honest interest rates over the last decade and longer.

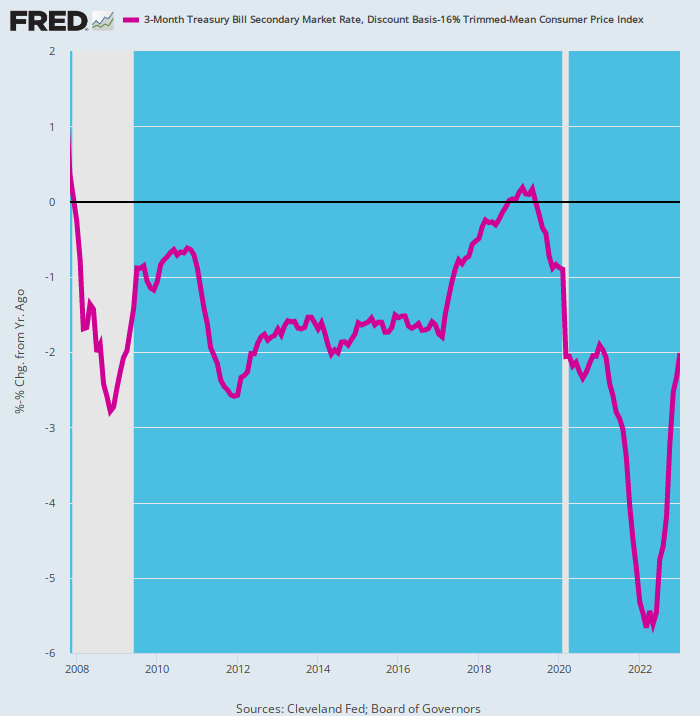

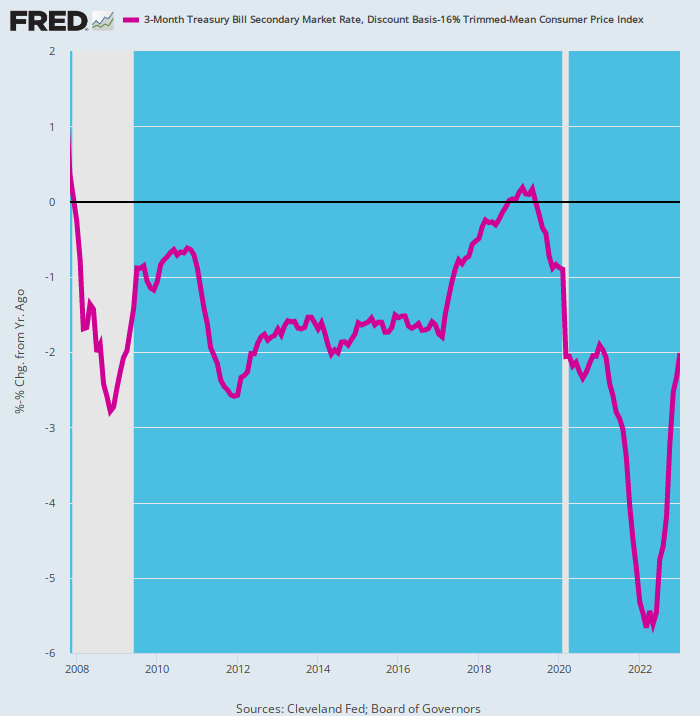

Indeed, if you were paying a smidgen of attention you saw SVB coming by a country mile. Here’s the Fed-engineered real interest rate on bank deposits since 2007. It was damn near a criminal invitation to managements to rob the bank and its depositors—legion’s of them.

After all, during only 8 of the last 192 months did the 90-day US Treasury bill have a positive yield after inflation, which we are measuring here as the 12-month rate of change in our trusty 16% trimmed mean CPI.

And we use the 90-day bill because its bears about as honest an open market rate as there is on the short-term money markets; it is overwhelmingly influenced and effectively set by the Fed’s peg of the Fed funds rate; and it is a generous version of the best that bank savings and CD depositors could have hoped for during the last 15 years.

Needless to say, it was also an invitation to any bank operator who could fog a mirror to legally rob their customers blind, while printing hundreds of billions of phony net income. In turn, these prodigious “earnings” caused bank stock prices to soar and executive stock options to explode in value.

For instance, when Silvergate failed earlier in the week, this SVB junior wanna be had seen its market cap soar by 18X in the 13 months ending in November 2021—-from $335 million to $6 billion. And then poof, it was gone for the same reason SVB hit the wall a few days later: Namely, it was foolishly arbitraging an utterly crooked yield curve that was the handiwork of the rotating cast of 12 nincompoops who comprise the Fed’s FOMC.

For crying out loud, look at the purple line below. Well more than half the time since the eve of the great financial crisis, the real yield was -2 percent or below. And not withstanding the 400 basis points increase in the Fed target rate since March 2022, it’s still 200 basis points underwater.

We will not even proffer the rhetorical questions as to “What were these people thinking?”

The Keynesian zombies domiciled in the Eccles Building evidently weren’t thinking at all.

Inflation Adjusted Yield On 90-Day US Treasury Bills, 2007-2023

What happened since Thursday, of course, is exactly par for the course. The entitled whiners of Silicon Valley were soon urging a thinly disguised backdoor bailout. These venture capital firms including Accel, Cowboy Ventures, Greylock, Lux Capital, Sequoia, and 600 more—which had yanked upwards of $40 billion in cash from SVB in a matter of hours on Thursday—-had signed a letter as of Monday morning expressing a “willingness” to work again with SVB under new ownership.

The events that unfolded over the past 48 hours have been deeply disappointing and concerning. In the event that SVB were to be purchased and appropriately capitalized,we would be strongly supportive and encourage our portfolio companies to resume their banking relationship with them.”

Well, here’s a news flash these VC geniuses perchance missed. To wit, into the wee hours Thursday morning SVB was trying to do precisely that—-raise $2.6 billion of fresh capital to plug the giant $1.8 billion hole in its balance sheet which allegedly appeared from out of the blue when it was forced to sell $21 billion good-as-gold US Treasury and guaranteed agency securities at their fair market value to fund deposit outflows.

Alas, on the free market the answer was a resounding, “No dice!”

Nobody with real capital was willing to put new money into a ballooning hole and for an obvious reason: The bank had $120 billion of mainly fixed rate debt securities as of December 31, 2022, which were already marked as big time losers, and that was before what was sure to be a tsunami of selling hit the massive but utterly artificially priced UST and Agency market.

SVB also had $71 billion of “loans” to VC “start-ups,” the preponderant share of which were cash-flow negative, sometimes even revenue negative. And that was before what is now sure to be in epic meltdown in the Silicon Valley start-up world.

Indeed, the blithering idiocy of SVB’s business model apparently knew no bounds. A goodly portion of their $200 billion of peak deposits consisted of burnable VC cash. That is, what they called “compensating balances” back in the 1960s that in this instance resulted from VC capital raises at ever higher valuations and proceeds from SVB loans.

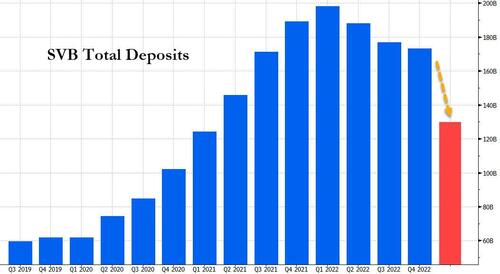

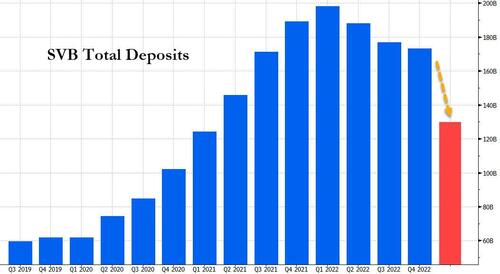

Accordingly, during the pandemic those client VCs and start-ups generated a ton of cash that led to a surge in deposits. SVB ended the first quarter of 2020 with just over $60 billion in total deposits, which skyrocketed to just shy of $200 billion by the end of the first quarter of 2022.

In turn, SVB Financial bought tens of billions of dollars of seemingly safe assets, primarily longer-term US Treasurys and government-backed mortgage securities. SVB’s securities portfolio rose from about $27 billion in the first quarter of 2020 to around $128 billion by the end of 2021.

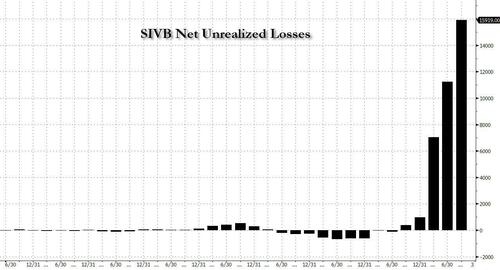

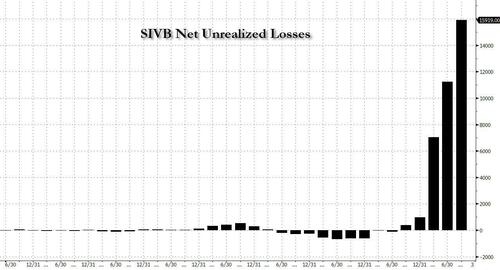

Yet the cash balances maintained by start-up clients was melting away like the morning mist, even as SVB’s unrecognized losses on its fixed income portfolio rose from less than $500 million in 2021 to nearly $17 billion by the end of 2022.

To be sure, until recently nobody cared about net unrealized losses on bank portfolios because, well, there simply weren’t any. But once the rate hikes started and debt prices—for anything from Treasurys, to MBS, to CRE—started to tumble, the unrealized losses began to soar. Or better said, began to slouch toward normalcy.

Of course, nowhere was this more visible than in Silicon Valley Bank’s own balance sheet, where from virtually no losses a year ago, the number climbed to $17 billion as of Q4.

At the same time, SVB’s deposit inflows turned to outflows as its clients burned cash and stopped getting new funds from public offerings or fundraisings. Attracting new deposits also became far more expensive, with the rates demanded by savers increasing along with the Fed’s hikes. Deposits fell from nearly $200 billion at the end of March 2022 to $173 billion by December.

On Wednesday SVB said it had sold a large chunk of its securities, worth $21 billion at the time of sale, at a loss of about $1.8 billion after tax. But following the announcement of these severe mark-to-market losses Wednesday evening, things went to hell in a hand-basket and fast. The attempted share-sale led the stock to crater, leading the bank to scuttle its share-sale plan almost as quickly as it had been announced. And venture-capital firms then began advising their portfolio companies to withdraw deposits from SVB.

On Thursday, customers tried to withdraw $42 billion of deposits—about a quarter of the bank’s total—according to a filing by California regulators. It ran out of cash.

And just like that, and after countless “never agains” from Washington officialdom a massive bailout of uninsured depositors happened just like that. Yet the disaster of that knee-jerk action is hardly cognizable.

Reprinted from Stockman’s private service now available on Substack

Join the conversation:

Published under a Creative Commons Attribution 4.0 International License

For reprints, please set the canonical link back to the original Brownstone Institute Article and Author.