Wow, now that’s a true splash of hope.

Elon Musk didn’t dawdle or temporize with respect to the crew of arrogant, incompetent thirty-something snits he inherited in the top jobs at Twitter. He just fired them on the spot.

And rightly so. These poseurs were corporate value destroyers because they apparently don’t know the difference between the actual job of top executives—maximizing profits—and playing juvenile ideological and partisan political games at the expense of business operations.

Yes, we know that Twitter is a private company and has every right to fire its #1 user—-the former president of the United States with 89 million followers. But that’s a red herring.

The company could also bleed its treasury dry by handing out big dollops of cash to every Tom, Dick and Harry who shows up at its headquarters with their hands out. But that would destroy shareholder value no less effectively than arbitrary partisan “content moderation,” meaning that the reward for both should be a hardy, Trumpian, You’re Fired!

To be sure, these four malefactors—CEO Parag Agrawal, CFO Ned Segal, Twitter’s censor-in-chief Vijaya Gadde and general counsel Sean Edgett—claimed to be protecting the company’s franchise with users and advertisers by censoring content deemed to be offensive. But that was a red herring, too, as proved by these excerpts from an interview Argawal gave to the MIT Technology Review in November 2020.

When asked about freedom of speech the now ex-CEO made it abundantly clear that his aim was to ideologically purify the public conversation for the good of society, not enhance the advertising revenues and user engagement levels of the company:

Our role is not to be bound by the First Amendment, but our role is to serve a healthy public conversation and our moves are reflective of things that we believe lead to a healthier public conversation. The kinds of things that we do about this is, focus less on thinking about free speech, but thinking about how the times have changed.

One of the changes today that we see is speech is easy on the internet. Most people can speak. Where our role is particularly emphasized is who can be heard. The scarce commodity today is attention. There’s a lot of content out there. A lot of tweets out there, not all of it gets attention…..

And so increasingly our role is moving towards how we recommend content and that sort of, is, is, a struggle that we’re working through in terms of how we make sure these recommendation systems that we’re building, how we direct people’s attention is leading to a healthy public conversation that is most participatory.

We attempt to not adjudicate truth, we focus on potential for harm…….So, we focused way less on what’s true and what’s false. We focus way more on potential for harm as a result of certain content being amplified on the platform without appropriate context……

We’ve been focused in our approach, and focusing on harm that can be done with misinformation around COVID-19, which has to do with public health, where a few people being misinformed can lead to implications on everyone.

There you have it. What does any of the above juvenile claptrap have to do with garnering more advertising dollars or increasing average monthly user stats or minimizing costs by not hiring an army of junior assistant censors who consume profits rather than generate them?

On the other hand, why on earth does this 37-year-old physics nerd and his like and similar underlings have any special wisdom about what constitutes “healthy public conversations”? Or, worse still, how could they possibly know what apparently true statements have so much “potential for harm” that they need to be censored, anyway?

For crying out loud, that’s tantamount to claiming powers of supernatural discernment.

Twitter’s phony “content moderation” operation was not unique, but symptomatic of a much broader perversion of corporate management throughout Silicon Valley and much of corporate America, too.

In a word, the stock market was so fantastically overvalued owing to the Fed’s egregious money printing that executives were given leave to pursue their political and ideological hobby horses on a whim, rather than keep their noses on the grindstone of profit and loss.

That is, stock prices were carried to such fantastic heights on the backs of utterly absurd valuation multiples that shareholders looked the other way. For instance, when Disney’s woke executives attacked the family values on which its franchise is based or when Amazon banned books that were perfectly saleable or when Facebook dumped overboard content and users that Mark Zuckerberg deemed unhelpful to the (D)emocratic cause.

Even PayPal, which ironically is the original source of Musk’s fortune, joined the fray. As Glenn Greenwald recently documented,

Perhaps the leading weaponizer is PayPal. Last year, PayPal announced a new partnership with the Anti-Defamation League (ADL), a once-respected group that battled anti-Semitism and defended universal civil liberties, before becoming yet another standard liberal Democratic Party activist group devoted to censoring adversaries of neoliberal orthodoxy (the ADL has, just as one example, repeatedly demanded the firing of America’s most-watched host on cable news, Fox News’s Tucker Carlson).

But predictably — indeed, by design — this “partnership” was nothing more than an ennobling disguise to enable PayPal to begin terminating all sorts of accounts of people and businesses who expressed political views disliked by its executives. Over the past year, a wide range of individuals have had their PayPal accounts canceled due solely to disapproved political views and activism.

The lesbian activist Jaimee Michell was notified by PayPal last month that the account of her activist group, Gays Against Groomers, was being immediately canceled due to unspecified rules violations. Moments later, the group — created by gay men and lesbians to oppose attempts by trans activists to teach trans dogma and highly controversial gender ideology to young schoolchildren — was notified that their account with PayPal’s subsidiary, Venmo, was also canceled immediately, leaving them with few options to continue to collect donations.

Around the same time, the British anti-woke and right-wing commentator Toby Young, who had created a group called the Free Speech Union to oppose speech-based cancellations of accounts, was notified by PayPal that the group’s account, used to accept donations, was also being cancelled; though PayPal refused to notify Young of the reason for the cancellation, it told The Daily Mail “it was trying to balance ‘protecting the ideals of tolerance, diversity and respect’ with the values of free expression.”

At the time of his PayPal expulsion, Young had become a vocal opponent of the UK Government’s escalating involvement in the war in Ukraine. Two of the sites on which this long-time right-wing figure relied for his opposition to NATO involvement in Ukraine were MintPress and Consortium News, two populist left-wing sites long devoted to anti-war and anti-imperialism policies. Several months earlier, those two anti-establishment left-wing sites were notified by PayPal that their accounts were being immediately closed, and that the balances in their account would be seized and may never be returned. PayPal refused to tell either news site, or Coinbase, which reported on the account closures, what its reasons were……..

Earlier this month, PayPal announced that it would fine account holders $2,500 if, in PayPal’s sole discretion, it was determined that those users were guilty of “promoting misinformation.” In other words, PayPal would just steal their own users’ funds from their account as extra-judicial punishment for the expression of views that PayPal — presumably working in conjunction with liberal activist groups such as ADL and billionaire-funded “disinformation experts” — decrees to be false or otherwise unacceptable. When this new policy provoked far more anger than PayPal evidently anticipated, they claimed it was all just a big mistake — as if some PayPal computer on its own accidentally manufactured a policy advising users about this seizure of funds.

The corruption of executive management by woke, partisan corporate culture reached it apotheosis at Twitter. How else can you explain its suppression of the infinitely damning Hunter Biden laptop story on the eve of the 2020 election?

Likewise, what other explanation is there for the escapades of a bunch of medically illiterate twenty-something kids in the content moderation department? They not only silenced dissenting doctors who disagreed with the sainted Dr. Fauci on mandatory lockdowns, masking or vaccinations, but actually generated so much unwarranted controversy about their dissemination of alleged “misinformation” as to cause these stalwart truth-tellers to lose hospital admission privileges or even their license to practice medicine.

Today is truly a new day, and not only because Elon Musk decisively punctured the woke political disease. It also turns out that Meta nee Facebook lost $80 billion or 24% of its value overnight, meaning that the $500 million gifter to the 2020 get-out-the-Dem vote campaign who runs it is now $100 billion lighter in the net worth department than he was a few months ago.

What we are saying is that Elon Musk is leading the way, but the ongoing crash of the second great technology bubble of this century may soon cure the disease entirely.

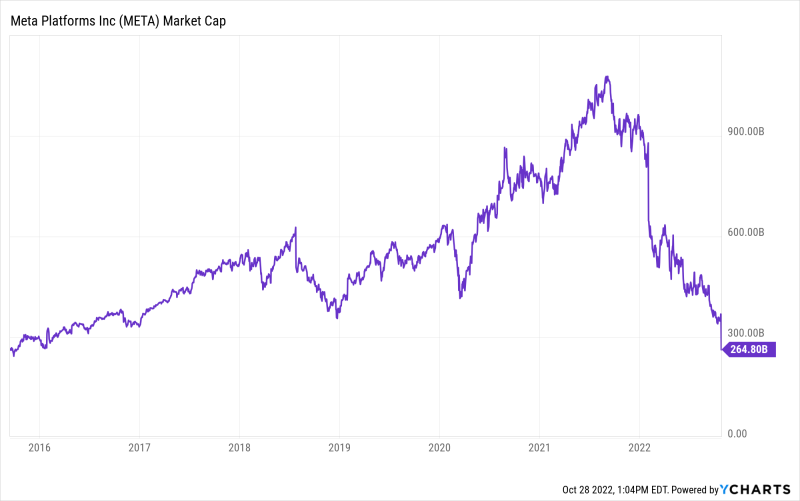

For instance, here is Facebook’s market cap since its absurd peak in September 2021. At that point it had a market cap of $1.078 trillion, which represented 34X its trailing free cash flow ($32.1 billion).

But here’s the thing. Facebook was being run by people who weren’t geniuses and most definitely did not have their eyes on the ball. Yet when you have a 34X free cash flow multiple you better be growing like Topsy as far as the eye can see.

Except, what has turned out to be Mark Zuckerberg’s face-plant, wasn’t. As we have argued all along, the company’s fulsome revenues and profits were the product of a one-time shift in advertising dollars from legacy media to digital forums, but that this shift was almost over, and that the tepid 2-3% per year revenue growth advertising industry would go negative, as it always does, during the next macroeconomic downturn.

That’s already happening, yet the real recession has not even fully arrived. Nevertheless, Facebook’s revenue suffered an unheard of 4.5% decline during the September quarter, while its expenses soared versus prior year.

Specifically, its costs and operating expenses were up by 19% from $18.6 billion to $22.1 billion; CapEx more than doubled from $4.2 billion to $9.4 billion; and cash flow from operations plunged by 31% from $14.1 billion in the September 2021 quarter to $9.7 billion.

The resulting free cash flow math does not get any uglier. That figure was $9.84 billion in September 2021, but had virtually vanished to just $317 million by the September 2022 quarter.

Needless to say, when free cash flow plunges by 97% even the robo-machines and day traders head for the hills. Accordingly, Facebook/Meta’s market cap is now just $264 billion, representing an $814 billion and 76% decline from its September 2021 peak.

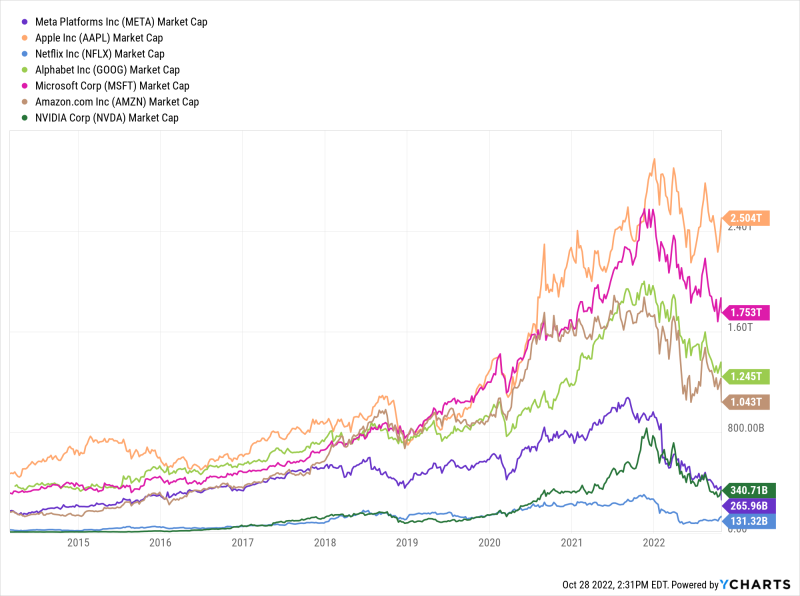

As it happens, all of the high-flying tech giants, previously known as the FANGMAN (Facebook, Apple, Netflix, Google, Microsoft, Amazon and NVIDIA), have been loosing gobs of market cap. After rising from $1.5 trillion of combined value in March 2014 to recent out-of-this-world peaks of $11.7 trillion last fall, the group has shed a staggering $4.4 trillion of value since then.

Indeed, the FANGMAN’s respective losses of market cap since last September is nothing short of astounding in nearly all cases except Apple, and the latter will have its day in the dunk-tank soon enough:

Loss of Market Cap/ % Percent Change:

- Facebook: -$814 billion/76%;

- NVIDIA: -$495 billion/59%;

- Netflix: -$160 billion/55%;

- Amazon: -$835 billion/45%;

- Google: -$760 billion/38%;

- Microsoft: -$850 billion/33%;

- Apple: -$500 billion/17%.

So the question recurs. Will a $4.4 trillion loss of market cap begin to sober up Silicon Valley and remind executives that their job is to maximize profits and shareholder value, not reform society in the name of woke ideology or any other political creed?

We have to think it’s a start, and with Elon Musk and Jay Powell leading the way, the corporate wake-up call emanating from the plunging stock market is going to get louder by the day.

Meanwhile, the Dems, libs and lefties may now find need to rant like rarely before. One Bridget Todd had a start this AM, but we suspect there will be a lot more shrieking to come.

“Elon Musk is about to rip open Pandora’s box and flood the internet once again with hate, misogyny, racism and conspiracy theories,” said Bridget Todd, communications director of feminist advocacy organization UltraViolet in an Oct. 4 statement. “We should all be terrified.”

Join the conversation:

Published under a Creative Commons Attribution 4.0 International License

For reprints, please set the canonical link back to the original Brownstone Institute Article and Author.