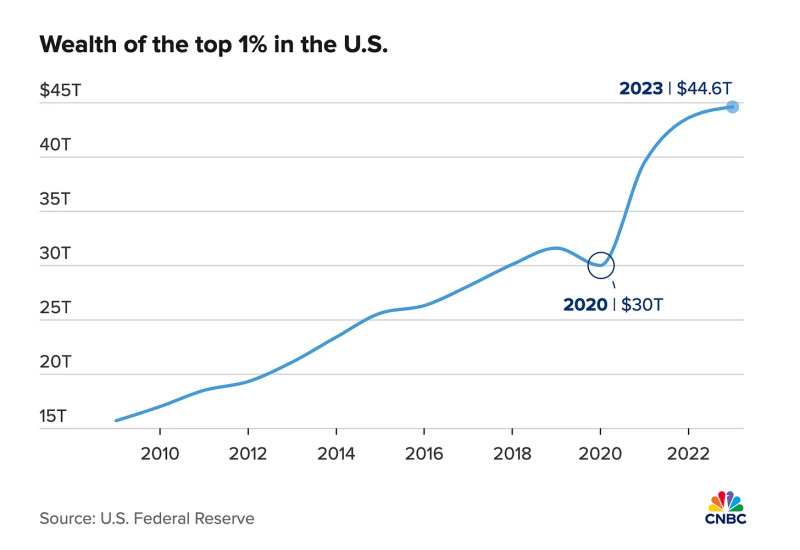

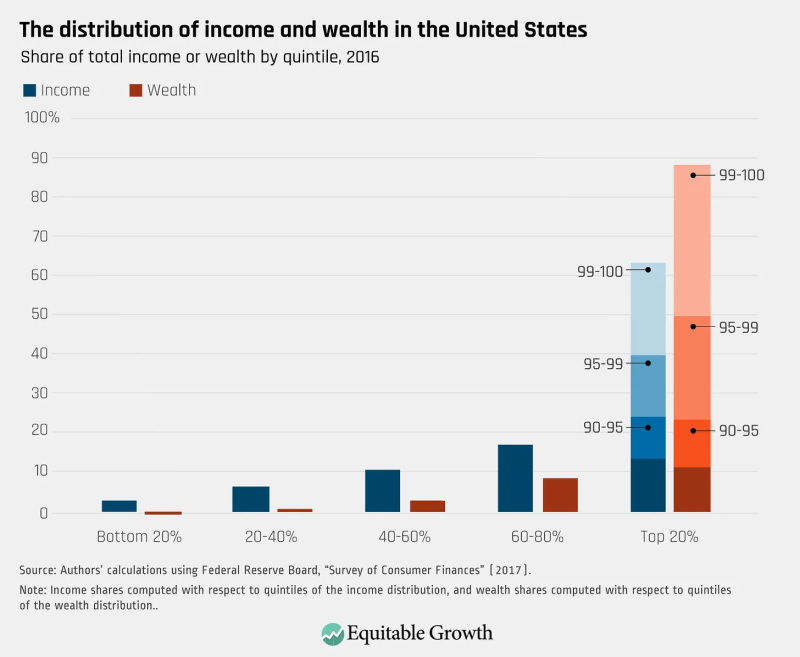

The rich are getting richer, the poor are getting poorer, and it’s all thanks to the Federal Reserve.

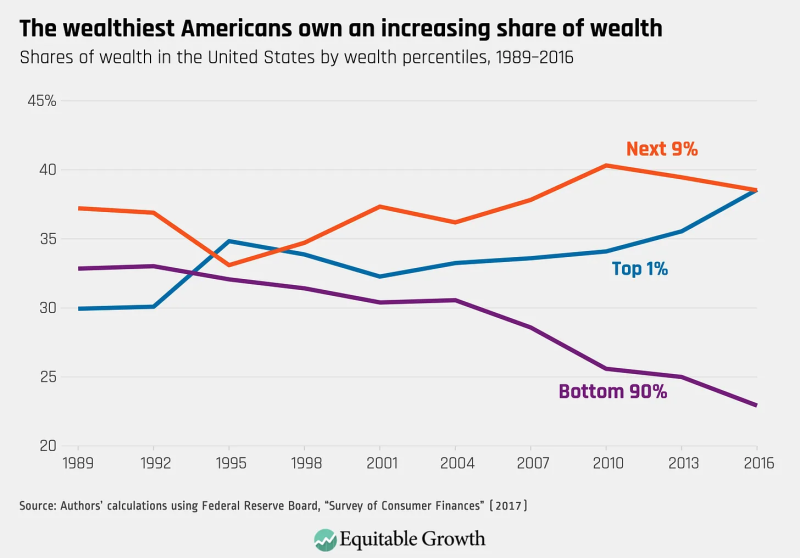

Last week the Fed released a new study that wealth of the top 1% in America hit an all time high of $45 trillion. That’s up $15 trillion, or 50% from 2020.

Put differently, the pandemic response has been just about the best thing to happen to America’s rich in, oh, a century.

Why? Because the pandemic set off the biggest tidal wave of money printing in American history, pumping out 6 trillion freshly printed dollars in just 2 years.

That was roughly one in three of all dollars in existence before the pandemic.

Free Money for Wall Street

That money, of course, pumped directly into financial markets — stocks gained $10 trillion over the period — stocks capitalize flows — and many trillions more poured into bonds, not least government debt — Treasuries — boosted by Federal Reserve purchases.

Why did it go to financial markets? Because that’s how the Fed prints money.

For better or worse, the Fed does not print new dollars on a machine and hand them out to everybody, rather it buys financial assets and subsidizes lending.

So-called Quantitative Easing is buying assets direct, but most of the new money is actually created by banks, who literally conjure money into existence when they make a loan.

In fact, since the Fed repealed reserve requirements during the pandemic, Wall Street is now free to lend into existence literally any amount their greedy little hearts covet.

The end result is new money goes, first, to financial markets and rich people via bank loans. The money then slowly trickles out to the rest of America, often long after prices have risen.

This is called the Cantillon effect, and it works like this: A rich guy gets a loan for a swimming pool. The money is spun from nothing — the bank effectively prints it, then charges interest.

He takes that fresh money and hires a bunch of workers. He pays them, they go to McDonald’s, the McDonald’s guy takes his dog to the vet, the vet buys a car, the car salesman pays his Mom’s electric bill.

At each step the new money spreads wider and wider. And it drives prices higher and higher.

Leaving Inflation for the Little Guy

So the rich guy got his money first, then each person down the line gets their money progressively inflated away. The last person in line is typically Social Security and pensioners who get nothing but inflation.

Normally, that Cantillon redistribution is small enough the victims don’t notice.

But in the pandemic they printed too much. Giving us soaring prices for everything from food to medical insurance to, of course, housing costs.

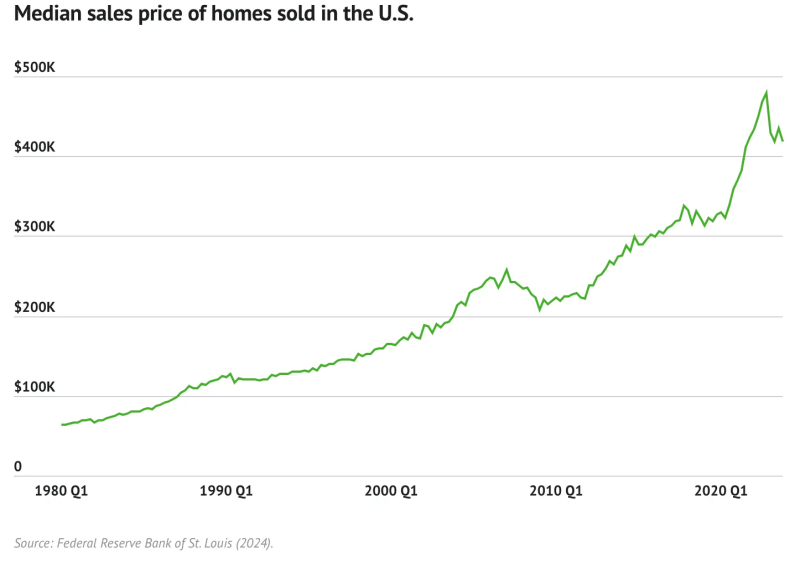

Since the pandemic, the cost of owning the median home in America has doubled, hitting close to $3,000 or half of median family income. In many cities, if you didn’t get a house by 2019, you will never own a house.

Conclusion

The fact the Fed drives inequality shouldn’t be a surprise: that’s the purpose of a central banks. It’s why Wall Street bought themselves a Federal Reserve back in 1914 — they didn’t do it for the McDonald’s workers.

So, yes, as long as we have a central bank the rich will get richer, and the poor will get inflation.

With the Fed eyeing a repeat of the 2022 inflation, America’s rich should get ready for another big payday. And everybody else can get ready for the fallout.

Republished from the author’s Substack

Join the conversation:

Published under a Creative Commons Attribution 4.0 International License

For reprints, please set the canonical link back to the original Brownstone Institute Article and Author.