The original vision for Bitcoin was simple: peer-to-peer digital cash, free from banks and government. However, the document argues that this vision was deliberately “hijacked,” as Bitcoin is now pushed as “digital gold,” a scarce asset for Wall Street, with slow and expensive transactions for everyday use.

This shift began with the 2015-2017 Block Size Fight, where a group won the argument to keep transaction blocks small, making the main network costly. The promoted “fix,” the Lightning Network, is a faster system but relies on middlemen (hubs), fundamentally changing it from true P2P cash.

The funding for this change is linked to Jeffrey Epstein. After the Bitcoin Foundation collapsed, his money flowed through MIT’s Digital Currency Initiative (DCI) to pay the core developers who favored the small-block path. Epstein also invested in Blockstream, a company started by those same developers.

Brock Pierce is identified as a key connector. He co-founded Tether, brokered Epstein’s Coinbase investment, and had an extensive relationship with him. Tether then played a crucial role in inflating Bitcoin’s price; a study suggests new, unbacked Tether, minted after price drops, accounted for roughly 50% of the 2017 bull run. The CFTC later fined Tether $41 million for lying about its reserves.

The control network continues with Howard Lutnick of Cantor Fitzgerald. Despite lying about cutting ties with Epstein, Cantor now manages Tether’s massive $130+ billion US Treasury reserves. Lutnick’s ally, Bo Hines, pushed the industry-friendly GENIUS Act while serving as a White House crypto advisor, only to immediately quit and become CEO of USAT, Tether’s US subsidiary.

The document views this as a coordinated “conquest,” with laws like the GENIUS Act and the CLARITY Act, and the Bitcoin Strategic Reserve, cementing insider control and preparing the ground for a tracked, programmable digital dollar. The author calls for immediate action to shut down these initiatives and support real alternatives like privacy coins.

Bitcoin was supposed to be simple: digital money you could send to anyone, anywhere, without a bank or government getting in the way. When Satoshi Nakamoto released the idea in 2008, it was described as peer-to-peer electronic cash, like handing someone cash in person, but over the internet. No middleman. No permission needed. Privacy protected. Freedom built in.

That sounded perfect to me. I live in New Hampshire, part of the Free State Project, where people are working every day to shrink government and expand personal liberty. Bitcoin felt like the financial side of that same fight: sound money that could not be printed endlessly or frozen on a whim.

Today, though, Bitcoin is sold as digital gold, something you buy and hold, not something you spend on coffee. Transactions are slow and expensive on the main network. Most everyday use happens on side systems that add layers of control. The whole story changed from cash for the people to scarce asset for Wall Street. That did not happen by accident.

It was hijacked.

The people behind it used money, connections, and influence to steer Bitcoin away from its original purpose. Key evidence comes from the Jeffrey Epstein court files, government investigations, academic research, and public records. The names that keep showing up are Brock Pierce, Epstein himself, and later Howard Lutnick. Their fingerprints are all over the shift, and the tools now being built on top of it, like the GENIUS Act (signed into law in July 2025), the CLARITY Act (passed the House in 2025 and advancing), and the Bitcoin Strategic Reserve (established by executive order in March 2025).

Here is what happened.

The Fight Over Bitcoin’s Size

Early on, everyone agreed that Bitcoin needed to handle more transactions as it grew. The simple fix was to make each block of transactions bigger, so more payments could fit every ten minutes.

Some developers pushed hard for that. Others said no, keep blocks small to make sure regular people could still run a full copy of the Bitcoin network on a home computer. That side won the argument. They kept blocks small, which made on-chain payments expensive and slow. Instead, they promoted Lightning Network, a separate system built on top of Bitcoin where most payments happen off the main chain.

Lightning works like opening a tab at a bar: you and the bar settle later. It is faster and cheaper for small payments, but it relies on middlemen (called hubs) who hold your money in channels and can see what you are doing. It is not the same as handing someone cash. It adds points where someone else can interfere or shut things down.

That small-block victory happened right around 2015-2017, during what people call the block size wars. Roger Ver, one of Bitcoin’s earliest and loudest supporters, has documented the whole story in his book Hijacking Bitcoin: The Hidden History of BTC. Ver argues that the original vision was deliberately buried so Bitcoin could be turned into something easier for big institutions to control. I would argue that Ver’s knowledge about the hijacking coupled with his steadfast promotion of the use of crypto as p2p digital cash (not as digital gold) is why he was targeted by the government and threatened with effectively life (109 years) in prison which I cover in detail in this article.

While Ver ultimately settled the case, he has effectively been silenced (any small infractions outside of a parking ticket) negates his settlement. After reading these Epstein files and the overlap with powerful people in the administration and those who benefit from the hijacked version of Bitcoin, I can’t help but think this is deliberate.

Who funded the winning side?

MIT Steps in, and Epstein’s Money Is There

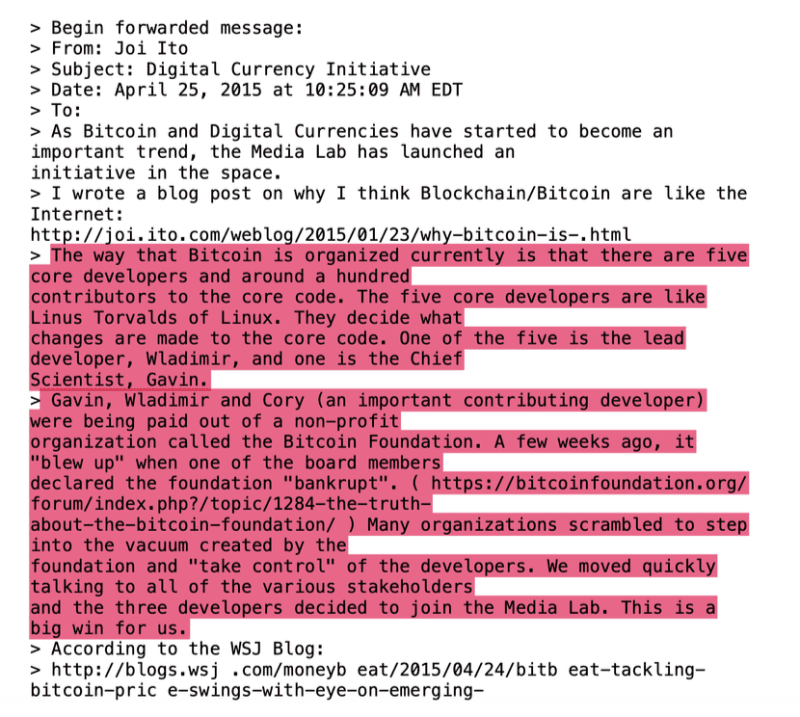

The group that controlled Bitcoin’s main software (called Bitcoin Core) used to get paid through the Bitcoin Foundation. That organization fell apart in 2015 after scandals and financial hardship. Almost immediately, MIT’s Media Lab Digital Currency Initiative started paying the same developers’ salaries.

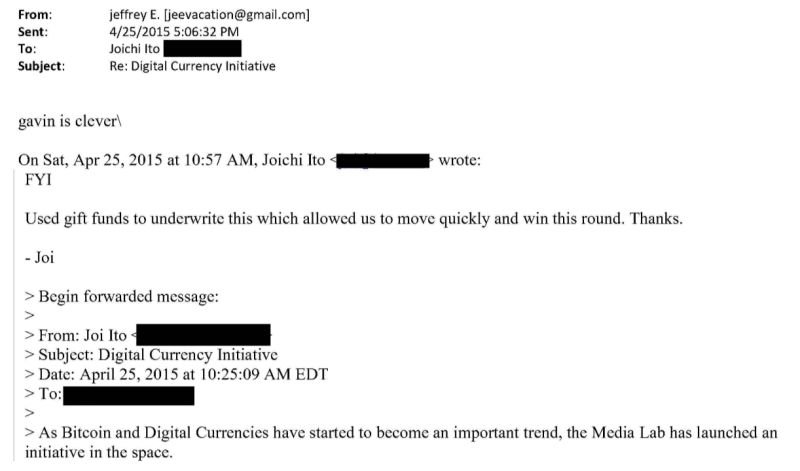

Jeffrey Epstein had given MIT $850,000 over the years, including $525,000 that went directly to the Digital Currency Initiative. The Media Lab director at the time, Joi Ito, hid Epstein’s name and called him Voldemort in emails. Ito quit in 2019 when the connections came out.

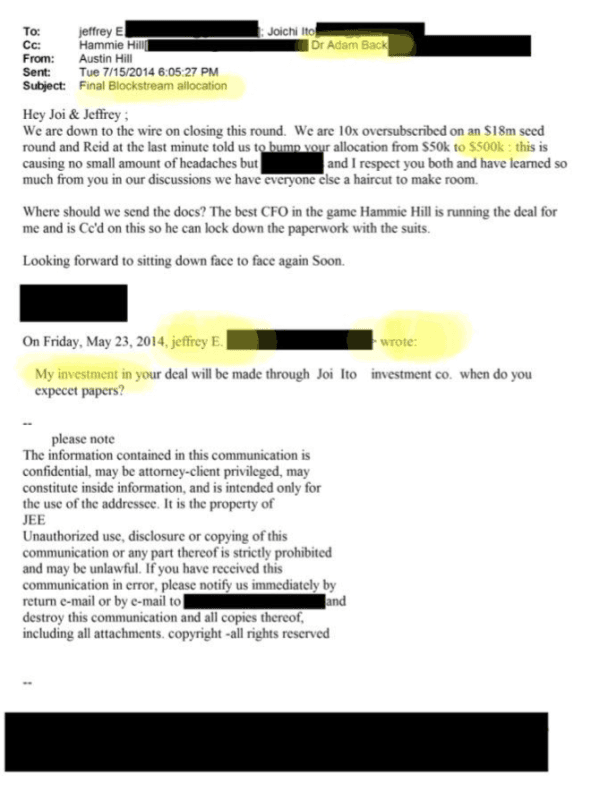

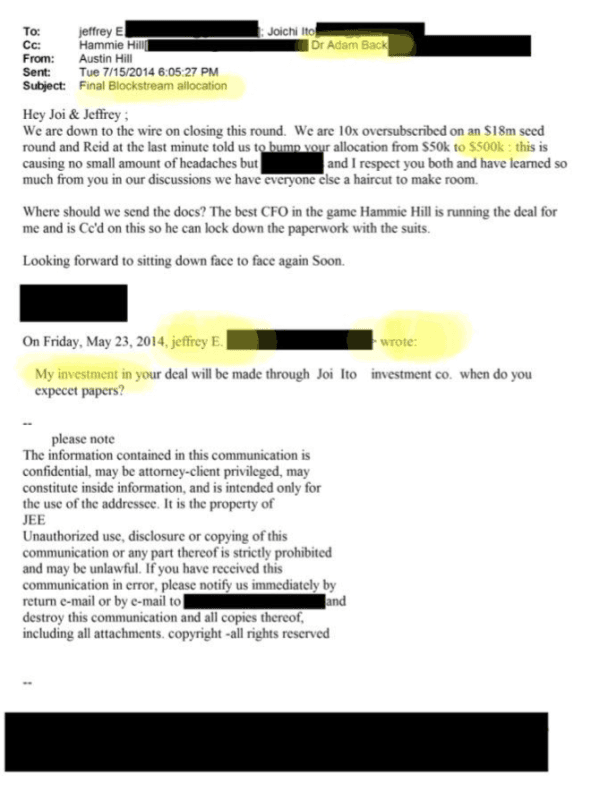

Epstein also put $500,000 into Blockstream, a company that built tools to keep Bitcoin on the small-block path and promoted Lightning Network. That investment came through a fund co-owned by Joi Ito.

But look at this actual email from the Epstein files, dated April 25, 2015. Epstein writes to Ito: “gavin is clever.” Ito had just thanked him for the “gift funds” that underwrote the Digital Currency Initiative launch:

This is Ito directly telling Epstein that his money let MIT “move quickly and win this round” by funding the devs who pushed the small-block path. Epstein’s casual reply about Gavin Andresen (Bitcoin’s lead developer at the time) shows he was paying attention.

Interestingly, it turns out that prior to funding the hijacking of Bitcoin, Epstein invested $500,000 in Blockstream (a company formed by Bitcoin Core devs that benefited financially from Bitcoin being hobbled).

At this point, we know definitively that Epstein surreptitiously (through Joi Ito’s investment fund) invested in a company started by Bitcoin core developers that benefited from Bitcoin being hijacked, and we know that Epstein also funded the developers that hijacked Bitcoin through Ito through the MIT Media Lab. We also know that Epstein funded the Digital Currency Initiative through Joi/MIT, which funded all 3 US CBDC projects – including Project Hamilton (which as a project between MIT and the Federal Reserve Bank of Boston) designed to replace the dollar with a trackable digital dollar making him the most influential person in charting the direction of digital currency (which we are actively dealing with today).

Brock Pierce: The Man in the Middle

No one ties the pieces together better than Brock Pierce.

Pierce first met Epstein in 2011 at the Mindshift conference on Epstein’s private island, Little St. James. From that point forward their relationship was extensive: dozens of emails, meetings, investment pitches, and business discussions that continued from 2011 all the way into 2018, with over 1,800 references to Pierce scattered throughout the broader Epstein files (including forwards, investor updates, and direct correspondence).

Pierce was chairman of the Bitcoin Foundation exactly when it collapsed in 2015 amid scandals. That collapse created the perfect opening for MIT (funded in part by Epstein) to step in and pay the core developers who locked in the small-block path. While chairing the Foundation, Pierce was also co-founding Tether in 2014 and running Blockchain Capital.

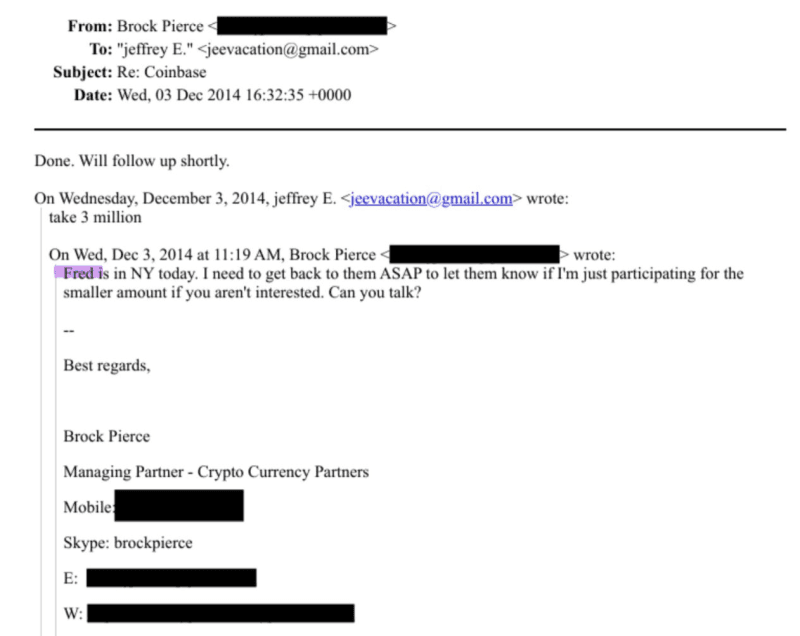

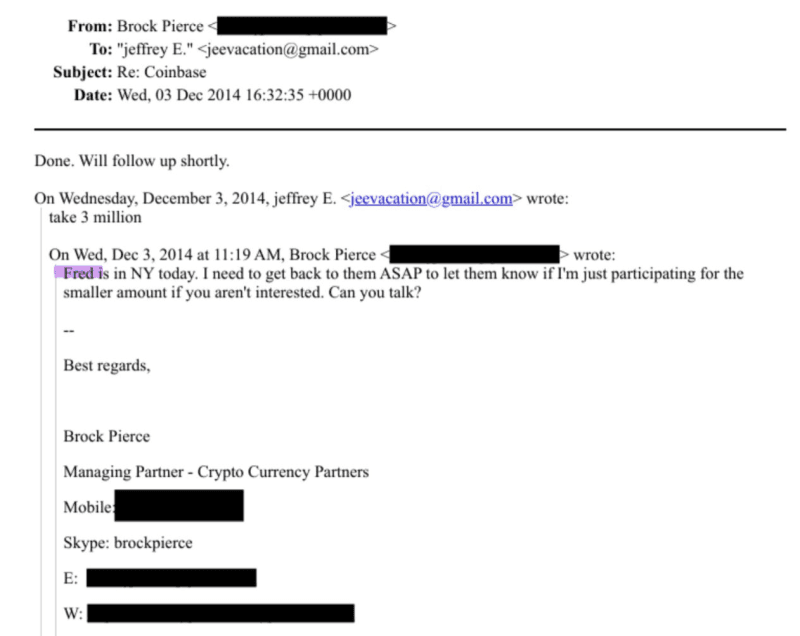

He personally brokered Epstein’s $3 million investment in Coinbase in late 2014. He arranged meetings, forwarded investor updates to Epstein, and pitched crypto deals directly to him.

One of the most revealing moments came at Epstein’s Manhattan mansion in 2014 or 2015. There, Pierce sat down with former Treasury Secretary Larry Summers and described himself as “the most active investor in Bitcoin.” Summers saw potential but worried aloud that getting involved could destroy his reputation because of Bitcoin’s wild price swings. Pierce even told Summers, “You’re going to have some low-quality characters playing early in the space.” Epstein facilitated the whole introduction.

Pierce kept the relationship going. In 2018 he was still emailing Epstein casually, pitching him on getting others involved with Tether and Noble Markets (the planned NASDAQ digital currency exchange). He treated Epstein like a normal, useful business contact.

In short, Pierce was the bridge. He knew Epstein early, ran the Foundation when it died (opening the door for Epstein-funded MIT to take over the developers), brokered Epstein’s Coinbase stake, introduced him to Larry Summers, co-founded the stablecoin that later pumped Bitcoin prices, and continued pitching deals for years.

The man who helped steer Bitcoin away from being usable cash was the same man feeding Epstein into the ecosystem at every level. In order for Bitcoin to successfully switch the narrative from digital cash to digital gold, it would have to prove its worth as a store of value. If the price of Bitcoin kept moving up, that would help to make that case. Brock Pierce was in the middle of Tether – a stablecoin that played the most influential part in increasing the price of Bitcoin in 2017.

Tether: Printing Dollars out of Thin Air

Tether is supposed to be worth $1 each. But the 2018 University of Texas study by John M. Griffin and Amin Shams showed new Tether tokens getting minted right after Bitcoin price drops in 2017, followed by massive BTC pumps. They calculated that Tether purchases accounted for roughly 50% of Bitcoin’s entire 2017 price run-up (and up to 64% for other top coins). Less than 1% of the hours with big Tether flows explained half the Bitcoin gains that year.

Straight up: someone printed unbacked Tether and used it to buy Bitcoin when prices were crashing, artificially inflating the price and creating the 2017 bull run illusion.

The paper is called “Is Bitcoin Really Un-Tethered?” (later published in the Journal of Finance). It looked at blockchain data and found the patterns matched classic manipulation, not organic demand.

Tether has never passed a full independent audit. It only puts out quarterly attestations from accounting firms like BDO Italia, limited snapshots that critics say are easy to game (move funds in right before the check, move them out after). The Big Four accounting firms have reportedly refused to do a real audit because they don’t want the reputational hit.

In 2021 the US Commodity Futures Trading Commission fined Tether and Bitfinex a total of $42.5 million ($41 million for Tether, $1.5 million for Bitfinex) for lying about reserves. The CFTC found that from June 2016 to February 2019, Tether falsely claimed that every USDT was backed 1:1 by dollars. In reality, it was fully backed only 27.6% of the time over a 26-month period. They also hid that reserves included unsecured loans and other non-cash junk. Tether settled without admitting or denying, but the numbers are on record.

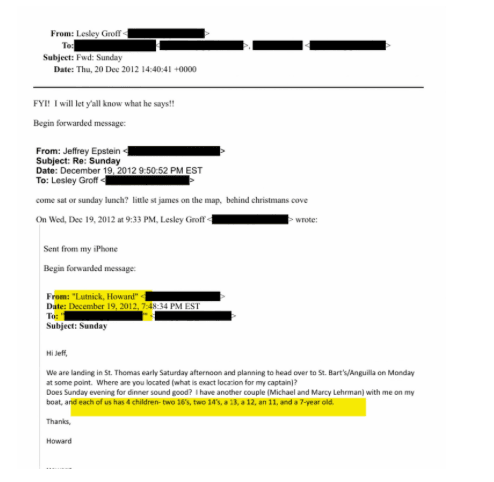

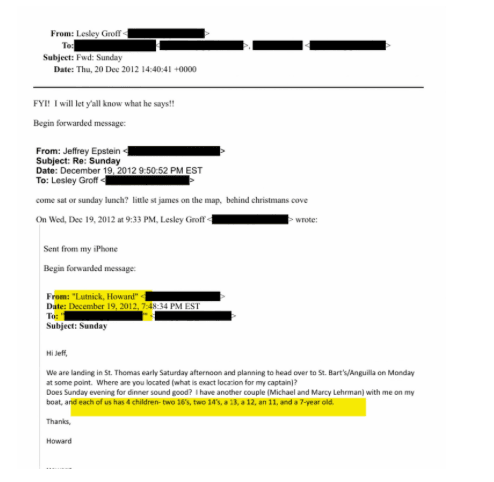

And who now controls the massive pile of US Treasuries that supposedly backs Tether’s reserves? Howard Lutnick and his firm Cantor Fitzgerald. The same Howard Lutnick who lied about cutting ties with Epstein after 2006, but whose emails show him planning a family visit to Epstein’s island in 2012 and accepting $50,000 from Epstein for a 2017 event. This is where the hijack gets even more blatant: the guy who helped pump Bitcoin with questionable stablecoin printing is now tied to the man managing the “clean” reserves that keep Tether afloat. The network that sabotaged Bitcoin as cash didn’t just stop in 2017; it kept evolving, and Lutnick is the next link in the chain.

Howard Lutnick Enters the Picture

Howard Lutnick ran Cantor Fitzgerald, a big Wall Street firm. He claims he cut ties with Epstein after 2006. But emails show him planning a family trip to Epstein’s island in 2012, and Epstein donated $50,000 to an event Lutnick hosted in 2017. Recent file drops include the exact 2012 email where Lutnick discusses bringing his family and lists the children’s ages. He had publicly sworn a 2005 meeting that left him revolted and that he never went near Epstein again. The contradiction is now all over X.

Cantor struck the deal to manage Tether’s massive US Treasury reserves, over $130 billion worth, and holds about a 5 percent stake in Tether, before Lutnick ever entered politics. He then joined the Trump transition team, lobbied aggressively for Treasury Secretary, was passed over, and landed at Commerce instead. Once inside, he positioned Bo Hines, his ally, as White House crypto advisor. Hines immediately pushed the GENIUS Act, the 2025 stablecoin law that gives Cantor Fitzgerald huge new fees, regulatory advantages, and cover while preserving the same loopholes Tether has exploited for years. Weeks after the bill passed, Hines left the White House and became CEO of USAT, Tether’s official US stablecoin subsidiary.

That is not a revolving door. That is a turnstile built by Lutnick for his own firm. Cantor gets the fees, the stake, the inside track on programmable dollars, and Epstein’s old network stays in control. We get the surveillance grid.

The Endgame: GENIUS, CLARITY, and the Bitcoin Reserve

This is the full circle.

Epstein funded the MIT devs who killed Bitcoin as cash.

Brock Pierce ran the Bitcoin Foundation into the ground, opened the door for Epstein’s money, brokered Epstein’s Coinbase stake, sat in Epstein’s mansion pitching Bitcoin to Larry Summers, co-founded Tether, and kept emailing Epstein until 2018.

Tether then printed unbacked dollars to pump Bitcoin 50% in 2017.

Howard Lutnick, who lied about cutting ties with Epstein, took over management of Tether’s $130+ billion Treasury reserves before he even joined the Trump transition. He pushed for Treasury Secretary, missed, landed at Commerce, installed his ally Bo Hines as White House crypto advisor, had Hines ram through the GENIUS Act, then watched Hines quit the White House and immediately become CEO of Tether’s U.S. subsidiary.

Every single player is connected. Every single move was coordinated.

The GENIUS Act entrenches the exact loopholes Tether has lived on.

The CLARITY Act hands regulatory cover to the same insiders.

The Bitcoin Strategic Reserve sits on top of a coin whose price was artificially inflated by the same stablecoin they now “regulate,” whose core development was funded by Epstein, and whose usability was deliberately destroyed by the people who profit from the fix.

This is not Big Short 2.0.

This is Big Short 2.0 on steroids, pre-planned, and run by the same network that already owns the outcome.

They created the crisis (crippled on-chain Bitcoin), printed the fake money to pump it (Tether), positioned themselves to own the “solution” (Blockstream, Cantor, USAT), wrote the laws that protect their scam (GENIUS, CLARITY), and are now preparing to step in as the saviors when the bubble they inflated finally pops. They walk away with fees, stakes, revolving-door jobs, and permanent control over programmable money. We get every transaction tracked, every dollar programmable, and the last remnants of financial freedom erased under the banner of “innovation” and “stability.”

This is not incompetence. This is conquest.

What We Should Do

The Epstein files are public. The University of Texas study is published. The CFTC fines are on record. The emails are in black and white.

Shut down the Bitcoin Strategic Reserve immediately. It is built on fraud and serves as a distraction.

Kill the CLARITY Act before it cements the control grid.

Repeal the GENIUS Act and slam the backdoor shut on programmable dollars.

Expose every connection. Name every name. Refuse to let policy be written on top of Epstein’s shadow.

Support real alternatives: privacy coins, sound money protocols, anything that keeps control in individual hands instead of this parasitic elite network.

Bitcoin was born to set us free. The files prove it was captured. The time to take it back is now.

Watch the latest The Brownstone Show with Jeffrey Tucker & Aaron Day: Bitcoin Hijacked? Epstein Files, Surveillance, and the End of Freedom Money

Join the conversation:

Published under a Creative Commons Attribution 4.0 International License

For reprints, please set the canonical link back to the original Brownstone Institute Article and Author.