This has been a week of spin, with every regime apologist assuring the public that inflation is getting better. Just look at the wonderful trend line! In the footnotes, you find the truth: it was a tiny drop and mostly for technical reasons and the main reason for the drop has already disappeared from the price trends.

The new claim: inflation will vex us for a bit more time but will settle down in a few months. It’s all Putin’s fault, plus the virus. In any case, the president is working to fix this.

Has any political propaganda on this topic ever been this ineffective?

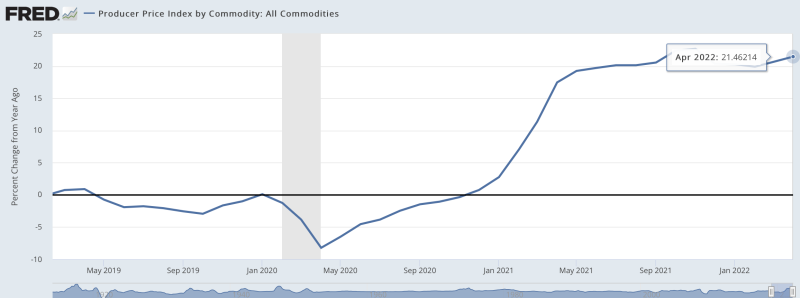

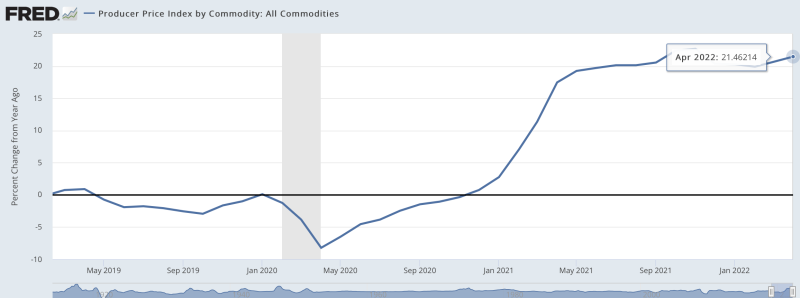

The producer price index that came out yesterday paints a clearer picture. It’s grim. It reveals no softening at all. In fact, it shows that there are plenty of price increases in the waiting. Here is the year-over-year change in the PPI by commodities 2013 to the present.

Remember how last year many people finally came to the conclusion that we had to learn to live with covid? That was a smart choice because there was no way that the China-style suppression method could work.

Well, here we are now with a preventable inflation pandemic and the realization that we have to learn to live with inflation. Soon we may realize that we have to live with recession at the same time.

But what does this mean?

The impact will be felt not just in terms of economics but in culture. Inflation causes a society-wide shortening of time horizons.

Live for Today

Let’s review some basics.

All societies are born desperately poor, fated to live off foraging and just getting by. Prosperity is built through the construction of capital, which is the institution that embodies forward thinking.

To make capital requires the deferral of consumption: you have to give up some today in order to make tools that enable more consumption tomorrow. This means discipline and a future orientation. And it means, above all, savings that can be invested in productive projects. Only through that path can societies grow rich.

A key component of this concerns the stability of the medium of exchange. And not just stability: a currency that rises in value over time incentivizes saving and thus investing for the long term. The late 19th century provided a good example of this. Under the gold standard, money grew more valuable over time, thus rewarding long term thinking and instilling that outlook in the culture at large.

Inflation has the opposite effect. It punishes saving. It forces a penalty on economic behavior that is future oriented. That means also discouraging investment in long-term projects, which is the whole key to building a complex division of labor and causing wealth to emerge from the muck of the state of nature. Every bit of inflation trims back that future orientation. Hyper inflation utterly wrecks it.

Living for the day becomes the theme. Taking what you can get now is the method and the theme. Grasping and spending. You might as well because the money is only going down in value and goods are in ever shorter supply. Better to live hard and short and forget the future. Go into debt if possible. Let the devaluation itself pay the price.

Once this attitude becomes instilled in a prosperous society, what we call civilization gradually devolves. If inflation persists, this kind of short-term thinking can wreck everything.

This is why inflation is not just about rising prices. It’s about declining prosperity, the punishing of thrift, the discouragement of financial responsibility, and a culture that gradually falls apart.

Another factor in reducing time horizons is legal instability. This was my first concern when the lockdowns began 26 months ago. Why would anyone start a business if governments can just shut it down on a whim? Why plan for the future when that future can be wrecked by the stroke of a pen?

There is a connection here with the huge rise in petty theft and real crime across the country. Stealing and hurting others reflects short time horizons. It is about getting something now, regardless of decency and morality. In that way, monetary devaluation has a relationship to the rise in crime.

Brent Orrell reports on the economic literature:

Enter criminologist Richard Rosenfeld—a professor emeritus at the University of Missouri-St. Louis who has spent the better part of the last decade researching explanations for U.S. crime trends. In 2014, Rosenfeld proposed a new answer to the “Great Recession paradox” that focused not on unemployment or inequality but on inflation.

Similar to the recession of 2008-10, the Great Depression saw an increase in unemployment and a drop in crime rates in the context of steep deflation. By contrast, in the 1970s, when inflation and unemployment took hold at the same time—the era of “stagflation”—crime rates rose. Inflation, not general economic hardship, appeared to be the culprit behind rising crime.

Rosenfeld’s follow-up research on inflation and crime has supported his initial conclusion. In 2016, he found that only inflation had consistent and robust short- and long-term effects on national property crime rates. In 2019, he reported that those results could be extended to the city level, once again confirming that inflation has significant effects on property crime rates. And this year, he published a new paper showing a significant association between inflation and homicide rates, especially in more economically disadvantaged communities.

Many people had assumed that this new path would be short lived. Surely the politicians would wise up and stop the madness. Surely! Tragically, it got worse and worse. The spending and printing began and ramped up over time. It was a perfect storm of sheer madness, and now we are paying the highest possible price.

The Hinge of History

We need to speak frankly about what’s happening to the global economy. It’s not just about supply chain breakages. Those can be repaired. It’s not just about inflation affecting every country. We are living amidst a fundamental upheaval of the whole world.

The biggest single danger to global prosperity now comes in the form of a devastating and deeply tragic wreckage of the country that was set to lead the world in finance and technology: China. The country accounted for 18% of global GDP, and a third of manufacturing output. The last two months have put that future in doubt. The entire world will suffer.

The trouble there traces to the top. When Xi Jinping locked down Wuhan, the world celebrated him for achieving what no other leader in history had achieved: the eradication of a virus in one country. Even now, he gets accolades for this. The rest of the world followed, and elites in all countries said that this path was the future.

Now the virus is on the loose all over the country, and the eradication methods are intensifying. This is crushing economic growth and now threatening genuine economic depression in the country that only a few years ago was seen as the greatest economic engine of the world. It’s truly the case that Xi Jinping has put his personal pride above the well being of all people in China. The scientists in the country know that he is wrong about this but no one is in a position to tell him. Plus he has an election coming up and is in no position to reverse course.

We cannot really trust the data coming out of China but officially the rate of infection in that country is one of the lowest in the world. Billions more people need to get the bug and recover in order to have anything close to herd immunity. This means that lockdowns are the way for years to come so long as the present regime remains in power.

American prosperity for decades has relied on: relatively low inflation, fairly stable rules of the game, and widening trade with the world and China in particular. All three are at an end. Yes, it is heartbreaking to watch it all unfold.

A friend put this well to me yesterday. We shut down the world for a year or even two and during that time, the stock market boomed and money arrived in our bank accounts as if by magic. It seemed like government could do anything and nothing would break.

Now we wake to a world in which breakage is everywhere. It turns out that governments have no magic wands to defy the realities of cause and effect in this world, and that applies to public health, economics, and culture too. When a regime shreds the learned wisdom of the ages, and rejects basic science as outmoded, there is a heavy price to pay. As a result, we find ourselves on a course that is not likely to be fixed for a very long time.

Join the conversation:

Published under a Creative Commons Attribution 4.0 International License

For reprints, please set the canonical link back to the original Brownstone Institute Article and Author.