New material Musk released over the weekend confirms the very worst. The banal boys and girls previously ensconced in Twitter’s top echelons were not only having a jolly time attempting to steer the nation’s news narrative; these executives were actually meeting weekly with FBI, Homeland Security and national intelligence officials to discuss “disinformation” they wanted removed from the site, including the notorious suppression of the Hunter Biden laptop story.

That’s just one step removed from a state-run Ministry of Truth and is perhaps even more insidious. That’s because it didn’t even involve unwanted and unconstitutional coercion. Instead, the executives of this private enterprise were voluntarily neglecting their day jobs (maximizing corporate profits and shareholder value) in order to spend a huge amount of corporate time and resources propagating official narratives and suppressing dissenting views.

It was as if the Washington powers-that-be had nationalized a multi-billion company, drafting it to propagandize in behalf of their own political and policy agenda and continued tenure in power.

So the question recurs as to why Jack Dorsey, Parag Agrawal, Vijaya Gadde, Yoel Roth and countless more top executives were not attending to corporate “biness”, but instead were ostentatiously moonlighting on behalf of an extra-curricular agenda that had absolutely nothing to do with making money at Twitter.

The answer is actually no mystery. The Twitter Files published so far by the trio of intrepid journalists given access to the company’s internal files—Matt Taibbi, Bari Weiss and Michael Shellenberger—provide a screaming case of the dog which didn’t bark.

Not once do any of these executives predicate their “content moderation” and thought control actions on the need to mollify advertisers and thereby protect corporate revenues and profits. Not once!

Actually, of course, the risk of losing advertising revenue would be a valid free market reason for “de-amplifying” content that caused revenue sources to wither. But no one averred that the NY Post’s dropping the dime on Hunter Biden would send GM or Proctor & Gamble advertising dollars packing or even that the user eyeballs on which those dollars depended would suddenly blink-shut owing to the horror of it.

Indeed, the eyes of the company’s collective leadership were so far off the eight-ball of profit maximization that they had seemingly endless time for the pursuit of all manner of foolishness and trivia on Twitter’s network. For instance, former Governor Huckabee’s obviously facetious tweet about fraudulent voting got the attention of the entire upper echelon:

Stood in the rain for hour to early vote today. When I got home I filled my stack of mail-in ballots and then voted the ballots of my deceased parents and grandparents. They vote just like me! #Trump2020,” Huckabee tweeted on Oct. 24, 2020.

The blatant attempt at humor here should have escaped no one’s attention with an IQ above 80. But as Matt Taibbi revealed, the bigwigs using the Slack channel titled “us2020_xfn_enforcement” actually hosted a lively debate about whether Huckabee’s tweet should be removed.

“Hello <here> putting this tweet on everyone’s radar. This appears to be a joke but other people might believe it. Can I get your weigh in this?,” a Twitter employee wrote, linking to Huckabee’s tweet.

Twitter’s former Head of Trust & Safety, Yoel Roth, said in the Slack channel that while he agrees “it’s a joke,” Huckabee is “also literally admitting in a tweet to a crime.”

“Yeah. I could see us taking action under ‘misleading claims that cause confusion about the established laws, regulations, procedures, and methods of a civic process’ but it’s not one that we could really label in a useful way, so it’s removal (of a stupid and ill-advised joke) or nothing. I’m maybe inclined not to remove without a report from voting authorities given it’s been a while since he tweeted it and virtually all of the replies I’m seeing are critical/counterspeech,” Roth said.

There are countless other examples in the Twitter Files of what amounts to trivia and pure partisan sniping garnering top corporate attention. In one tweet, Donald Trump referenced a mail-in voting problem in Ohio that was found to be true.

Nevertheless, Twitter executives were praised for their speed to impose “visibility filters” so the tweet could not be “replied to, shared, or liked,” and the staff received a censorship “attaboy”: “VERY WELL DONE ON SPEED.”

Still, that was Donald Trump the sitting president—so presumably he was worthy of top level censorship. But what about one John Basham, a former Tippecanoe County, Indiana, Councilor?

The latter had apparently caught the attention of the FBI, which sent a report to Twitter for action owing to the fact that Basham claimed,

“Between 2% and 25% of Ballots by Mail are Being Rejected for Errors.”…

Let’s see. Does the opinion of an ex-official from a place that no one has heard about since the election of 1840 (“Tippecanoe and Tyler, Too”), implicitly claiming that the mail-in error problem was either huge (25%) or relatively trivial (2%), really matter when it comes to running a global corporation, or even a government-contracted censoring operation for that matter?

That is to say, these kids and half-baked partisan ideologues were in so far over their heads that it was only a matter of time before the whole enterprise ran aground. Indeed, they had formulated so many rules for content moderation and such complex multi-stage forms of penalty, including parental-style “timeouts”, that much of the internal debate revealed in the Twitter Files amounted to arguments about the application of sheer stupidity.

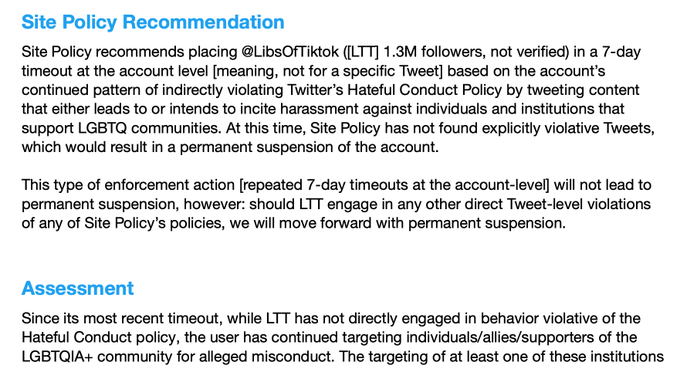

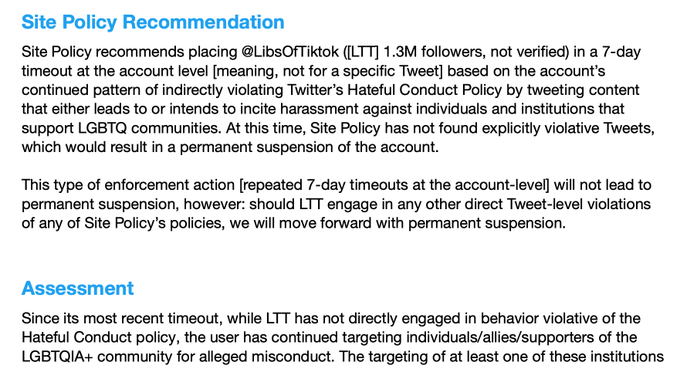

This was more than evident in the case of Twitter’s seven suspensions of the “LIBs of Tik Tok” (LTT) account. This Twitter account was launched by one Chaya Raichi in November 2020 and now boasts over 1.4 million followers. Each time, Raichik was blocked from posting for as long as a week.

Yet what was the offense? The committee justified her suspensions internally by claiming her posts encouraged online harassment of “hospitals and medical providers” by insinuating “that gender-affirming healthcare is equivalent to child abuse or grooming.”

Actually, that’s a red hot matter of judgement and opinion that can be argued either way—the exact kind of thing that is supposed to be debated in the town square. But either way, the Twitter claim that the LTT viewpoint on the matter amounted to “hate speech” reveals just how far off the deep-end these wokish juveniles had descended.

Still, what matters here is the wording of the Site Policy Recommendation: It’s all about school playground style punishments, and nothing at all about the needs of the business or viewpoint of advertisers.

Meanwhile, what was happening back at the ranch in 2020-2021 when the Twitter HQ was being transformed into the Village of the Damned?

Well, on the one-hand the company’s stock price was coming up roses. After hitting the skids in 2015-2016, the Twitter’s market cap had risen from $12.5 billion in the fall of 2017 to $27 billion by the fall of 2019 to a peak of $54 billion in July 2021.

In short, given a quadrupling of the company’s stock price in just four years and the resultant massive gains in the value of executive stock options, the top echelon apparently felt free to become moonlighting volunteers for the Deep State. That is, doing well they faced no penalty for doing good at the shareholders’ expense.

And we do mean shareholders’ expense. During its 2020 and 2021 fiscal years combined, which encompassed the peak period of the C-suite insanity chronicled by the Twitter Files, the company did harvest $8.8 billion of revenue from the Lockdown-world’s acceleration of the advertising migration from legacy to digital venues.

Moreover, collecting those sums only required $3.2 billion in cost of goods sold, resulting in sterling gross profits at $5.6 billion and 64% of sales. In turn, that should have resulted in a shareholder bonanza on the bottom line. Except it didn’t.

In fact, the company’s moonlighting management spent far more than that—$6.1 billion—on R&D, sales and marketing, general overhead and other top-side expenses. That is to say, Twitter’s putative business model went bust, with cumulative operating losses of nearly one-half billion dollars during the two year period.

Likewise, its bonifides as a cash-burning machine were reinforced. During 2020-2021 it generated $1.6 billion of cash from operations, but spent nearly $1.9 billion on CapEx. Accordingly, Twitter’s operating free cash flow came in at -$260 million.

In short, when the company reached a peak valuation of $54 billion in July 2021 it was bleeding red ink and burning cash. It essentially had an infinite valuation multiple, which absurd valuation, in turn, amounted to a flashing green light for rampant moonlighting by not only its top management, but nearly the entirety of its the 7,500 work force.

In that regard we have been waiting for our Twitter screen to go dark ever since Elon Musk fired the employment rooster back to at least its December 2017 level (3,372). But, alas, the tweets just keep on coming, even as expenses have been pared back to the levels extant when Twitter was valued at the aforementioned 25% of its eventual peak.

The Twitter story is not a one-off case, nor is it evidence that Wall Street and the homegamers alike are comprised of greedy fools who will fall for anything.

To the contrary, the destructive outbreak of corporate moonlighting in behalf of woke ideology and partisan causes was born, bred and matriculated by the money-printers at the Fed. At the end of the day, it is bad money that leads to bad, value-destroying behavior in the C-suites—just one more instance of the “malinvestment” which is the inherent result of monetary inflation.

In this context, the unjustified bubble in the Twitter stock is actually small potatoes compared to the giants of Silicon Valley—all of which have been infected with the same bad money based descent into political moonlighting.

As it happened, the stock of the FANGMAN (Facebook, Apple, Netflix, Google, Microsoft, Amazon and NVIDIA) got enormously bloated by the Fed’s rampant money-printing during the last decade.

Thus, in 2013 these seven tech giants were collectively valued at $1.19 trillion, which figure represented 15.9X their combined net income of $75 billion. Arguably, that PE multiple was reasonable and appropriate given the fact that most of these companies were growing rapidly but were also benefiting from a one-time headwinds.

These included—

- the shift of advertising from legacy to digital media;

- the migration of merchandise sales from bricks and mortar stores to e-Commerce;

- the shift of computer technology from standalone boxes and their packaged software to the cloud; and

- the full adoption of smart-phone technology by the mass public.

These one-time tailwinds did result in a 20% per annum earnings growth for the seven FANGMEN during the 2013-2021 period. But the flood of Fed liquidity during the same period caused the PE multiple to more than double to 34X based on the view that the Fed would never let the market decline; and also that the rock-bottom interest rates would remain in place indefinitely, resulting in the baleful reign of TINA (there is no investment alternative to stocks).

Accordingly, the market cap of the seven companies soared to $11.5 trillion by the fall of 2021, representing a 33% per year gain. In turn, this meant not only that market caps had grown 1.5X faster than unsustainable one-time earnings gains, but that C-suites throughout Silicon Valley had no trouble taking their eye off the profits maximization ball in order to pursue political agendas that had nothing to do with good management of their respective businesses.

Alas, the worm has turned. The market cap of the FANGMEN has already dropped by a staggering $4.5 trillion to just $7.1 trillion at present. At the same time, collective earnings of these allegedly perpetual “growth” stocks have declined by nearly 14% since their summer/fall 2021 peak of $336 billion.

By our lights, companies experiencing double-digit earnings shrinkage—even before the upcoming recession—do not deserve the 24.5X multiple the market is now putting on their collective profits of$290 billion.

Likewise, shareholders never deserved the $4.5 trillion that has already vaporized, even as they were being badly served by management that had gone AWOL, moonlighting on wokeness and politics.

In all, bad money is the ultimate devil’s workshop. The bloodbath in Silicon Valley stocks and the Twitter Files disclosures enabled by the proprietor of Tesla, its most hideously over-valued company, are finally proving exactly why.

Reprinted from David Stockman’s paid service.

Join the conversation:

Published under a Creative Commons Attribution 4.0 International License

For reprints, please set the canonical link back to the original Brownstone Institute Article and Author.