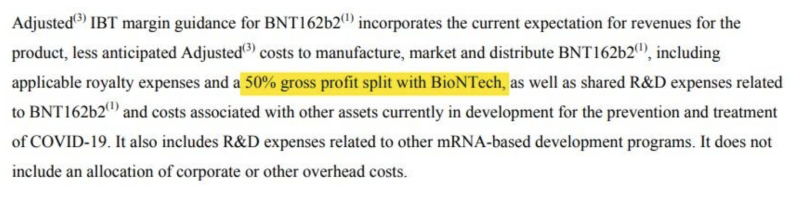

The below is excerpted from Pfizer’s reported 2021 2nd quarter results. It refers to the company’s profit margin on sales of what is commonly known around the world as the “Pfizer” Covid-19 vaccine or, per its scientific codename, BNT162b2.

The highlighted information is also present in other Pfizer earnings reports. It is, namely, that Pfizer splits profits on sales 50-50 with the actual developer and owner of the product: the German firm BioNTech.

This means that the main financial beneficiary from sales of the “Pfizer” vaccine is in fact BioNTech. How so if the split is 50-50? Well, apart from its 50% share of the profit on Pfizer-branded sales, per the terms of its collaboration agreement with Pfizer, BioNTech also does direct sales in two reserved territories (Germany and Turkey), and, furthermore, it has a separate agreement with Fosun Pharma assuring it (per its own representations to the SEC) 30 to 39 percent of profits on sales in China. (For lack of authorization, the latter have thus far been limited just to Hong Kong.)

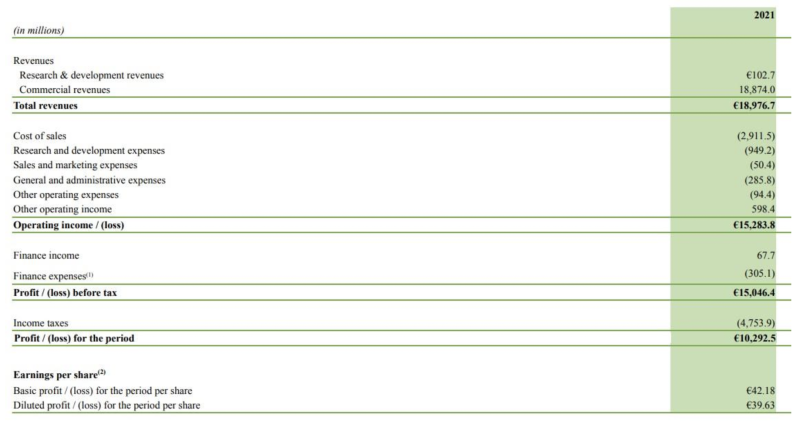

But if BioNTech’s profits on sales of the “Pfizer” vaccine are greater than that of Pfizer in absolute terms, its profit margin is far, far greater. This is because while BioNTech earns a 50% share of profits on Pfizer-branded sales, it does not share the associated manufacturing and marketing costs. The 50% are royalties.This explains BioNTech’s whopping 2021 pre-tax profit margin of 79%! See the below chart from BioNTech’s 2021 F-20 filing to the SEC. Over 15 billion euros in profits on nearly 19 billion euros in revenues, roughly equivalent to the same figures in dollars at the current exchange rate. Note too that BioNTech paid nearly one-third of those 15 million euros as corporate tax in Germany. BioNTech has never commercialized any other product. So, virtually all its profits are related to the “Pfizer” vaccine.

The same Pfizer earnings report cited above estimates Pfizer’s own pre-tax profit margin – or here Income Before Tax (IBT) margin – on sales of the vaccine as being somewhere in the “high-20s” (p. 4). So, BioNTech’s profit margin on sales of the “Pfizer” vaccine is roughly three times higher than Pfizer’s.

Moreover, if we split the difference and say that Pfizer’s pre-tax profit margin is 27.5% and we apply this profit margin to Pfizer’s reported full year 2021 revenues on BNT162b2 sales of nearly $37 billion, we obtain gross profits on sales of roughly $10 billion. (For Pfizer’s full year 2021 revenues on BNT162b2 sales, see p. 35 of Pfizer’s year end report here. The product is identified as “Comirnaty.”)

BioNTech’s profits on sales of the “Pfizer” vaccine are thus roughly 50% greater than Pfizer’s profits: 15 billion dollars (or euros) to 10 billion.

So, in short, why is there so much focus on Pfizer in public discussion of the Covid vaccine market, virtually to the exclusion of BioNTech and even in discussion by seasoned financial analysts?

Indeed, why is the product in question even called the “Pfizer” vaccine? This is obviously a misnomer. It is BioNTech’s vaccine (supposing it is a vaccine). BioNTech developed and literally owns it. Hence, its scientific codename: BNT162b2. Pfizer merely manufactures and sells it in certain (but not all) markets on BioNTech’s behalf.

BioNTech was also the sponsor of the famous clinical trials that led to the vaccine’s authorization. This is indicated, for example, on all relevant FDA documents. Pfizer merely carried out the trials, yet again, on BioNTech’s behalf. And BioNTech is the marketing authorization holder on every market where the product is sold by Pfizer, as well, of course, as on its own reserved markets. And, finally, BioNTech is, as shown above, by far the principal financial beneficiary of the product’s commercialization.

This is not just a “semantic” matter. We need to name things correctly to understand them correctly. The intense focus on Pfizer, to the point of making BioNTech virtually disappear, has, among other things, created an illusion of Pfizer’s global power and diverted attention from state actors: in particular, Germany, which, as shown in detail in my earlier Brownstone article here, sponsored the BioNTech vaccine and has a major economic interest in the global success of both product and firm.

Indeed, as discussed in that article, the German government sponsored the very founding of BioNTech as part of a “Go-Bio” funding program whose express purpose was to make Germany a leader in biotechnologies.

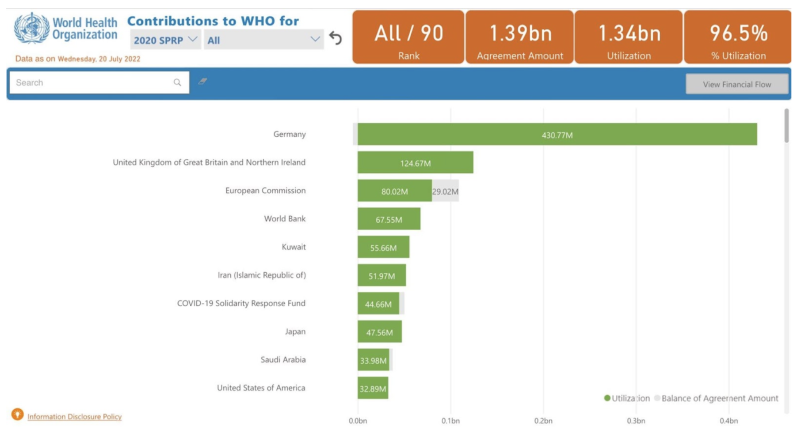

As so happens, unbeknownst to most observers, Germany has also been far and away the principal funder of the WHO’s vaccine-centric global Covid-19 response. Below, for instance, is a chart showing the leading contributors to the WHO’s 2020 Covid-19 response (SPRP) budget.

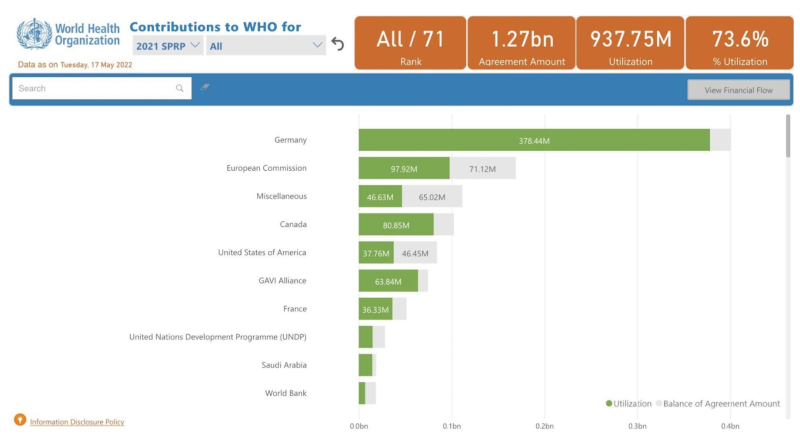

As can be seen below, 2021 was not very different.

But that is a story for another time…

Published under a Creative Commons Attribution 4.0 International License

For reprints, please set the canonical link back to the original Brownstone Institute Article and Author.