Have you ever wondered what or who really funds the activities of hegemonic America, from its domestic spending through to its foreign wars? The answer isn’t immediate and it may surprise you.

The first thing to understand is what it really means to fund something. Funding for American activities is provided through dollars, where “a dollar” represents a certain amount of purchasing power at a particular moment. Any government needs purchasing power in order to employ people and buy things, so the US government wants to have dollars.

According to economics textbooks, governments get their purchasing power by taking away currency from their populations and companies via taxation. In this textbook model, printing more currency with which to buy things and employ people is also a kind of taxation in which government can engage, because printing more money (all else fixed) increases the supply of money and thereby reduces the “price,” i.e., the purchasing power, of the currency already held by everyone else.

With no commensurate increase in the demand for money, the expansion in money supply created by American money-printing leads to all existing dollars buying fewer goods than before the money-printing. Nobody sends a bill: the tax just happens, with every clank of the government printing press. Doubling the amount of money in circulation via the printing press, and then giving the printed money to the government to buy stuff with, is basically the same as the government taxing half of private-sector income and buying stuff with it.

The implicit tax created by American money-printing can be avoided by simply not accepting dollars in exchange for labour and goods (and accepting instead, say, some other less-diluted currency, or goats. Or onions, for that matter). This is why runaway money-printing eventually leads to runaway inflation and an economic crash, as people flee from the inflated currency to avoid the implicit taxation.

Tributes to him who wields the mint

This implicit tax from money-printing is known in economics as a seigniorage tax, and it doesn’t apply only to a government’s citizens. In fact, if a lot of domestic currency is held abroad, then a lot of the seigniorage tax bill created by just printing money is paid by foreigners holding that currency.

It turns out that there are an awful lot of US dollars held right now by foreign countries, and particularly by supposed enemies of the US.

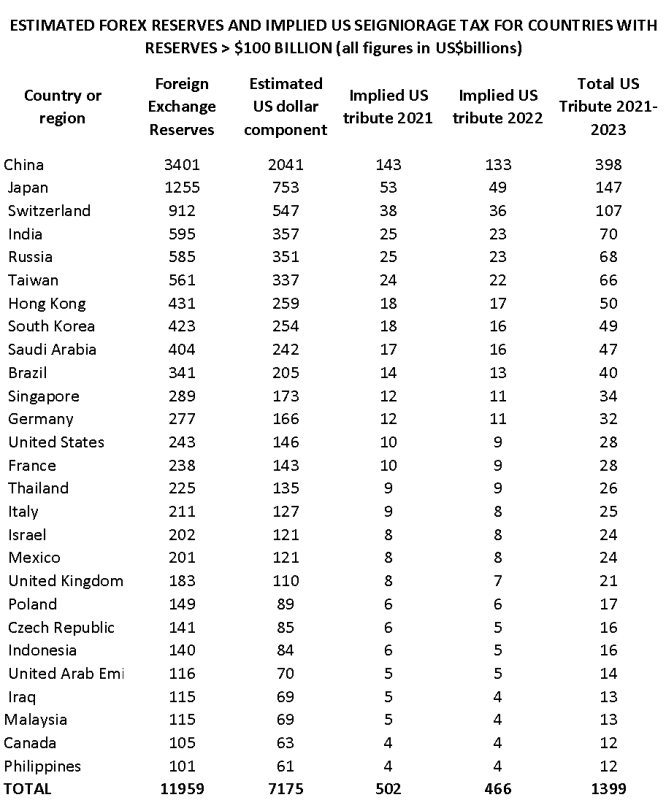

The second column in the table below lists the current estimates of the value of foreign reserves held by each country in the world that holds at least $100 billion of such reserves. Approximately 60 percent of these foreign currency-based reserves are estimated to be in US dollar-denominated assets (as quantified in column 3).

The numbers in the table capture only the foreign reserves held by each country’s central bank, though individuals, corporations and other entities can and do also hold foreign currency – and for all manner of reasons. Tax evasion is one (in the case of US dollar-denominated reserves in Switzerland), but foreign currency holdings are also useful to many people as a buffer against shocks to the economy and as a means to insure the value of their local currencies.

A crucial aspect of foreign reserves is that they don’t earn significant interest from the US Federal Reserve. For example, over the past 10 years, the average yield on the 10-year Treasury note, i.e., a benchmark rate of return on an important component of international reserves, was 2.2 percent, falling to as low as 0.55 percent in late July 2020. These instruments are more like cash than like shares or other equities that typically rise in price with inflation and general prosperity. When inflation hits, they lose roughly the equivalent amount in purchasing power relative to a situation with no inflation. They are ripe for the seignior to take his tax via the printing press.

Hence, when the US Federal Reserve prints money to buy the debt of the US government, it usurps purchasing power for the benefit of the US government and US institutions. Via the inflation created by its expansion of the money supply, the Fed takes away the purchasing power of all other deposit holders of US dollars, including the countries above.

In the table’s final columns, we have done some very crude calculations of how much purchasing power these countries have lost due to inflation over the past few years. For simplicity, we assume that the latest figures on held reserves are valid for the entire 2021-2023 period, which is merely a reasonable approximation rather than strictly true. We also assume inflation figures in 2021, 2022 and 2023 of 7.0 percent, 6.5 percent, and 6.0 percent, respectively. One can easily make these calculations more sophisticated and accurate, taking account of Treasury yields, making distinctions about who within the US benefits, and accommodating various other nuances. The numbers in the final columns should be read merely as first-order approximations.

What the table reveals is the scale of the seigniorage tax that foreign governments have paid the US in 2021, in 2022, and in the whole period of 2021-2023.

The Chinese have subsidised the US to the tune of about $400 billion of purchasing power, or close to half the FY2023 US defence budget. Japan and Switzerland have paid the US an implicit tribute of more than $250 billion between them over the 2021-23 period, and even Russia has chipped in with about $70 billion. The 27 countries in this table had about $7.2 trillion in US dollar-denominated assets in their reserves, resulting in their paying the US a total tribute over this period of nearly $1.4 trillion worth of purchasing power.

There are more physical dollars owned by foreigners than this table shows. Also going uncounted is a large number of Eurodollars. Eurodollars are essentially rights to US dollars in banks owned and traded outside of the US. Because they are a call upon goods and services, Eurodollars have purchasing power that changes just as that of other dollars. If you extend the logic of the table to the whole of the ‘Eurodollar market’ that is believed to be worth around $20 trillion, then the US has received implicit subsidies of about $5.3 trillion from the rest of the world in the past few years. That’s almost 7 years’ worth of US military budgets.

Since the US Federal Reserve has printed about $6 trillion in this period to be used by the US government and US institutions, it would not be wrong to say that most of the Fed’s money-printing was paid for in the form of an inflationary tribute from the rest of the world. Domestic dollar-holders lose to the money printing too, but domestic households and companies also benefit from the extra government expenditure using the printed dollars.

Frenemies

Strikingly, the supposed arch-enemies of the US today – China and Russia – are contributing significantly to US financial solvency. Russia is paying the US far more than the Ukraine war is costing the US, and China is paying the US far more than the total cost of all the military bases surrounding China. The Chinese and Russian governments failed to dump their US dollars and Treasury bills in 2020 when the US Federal Reserve started printing truckloads of money and it was clear to the financially literate what was going to happen to inflation (even we predicted it in print in November of 2020).

If the Russians and Chinese had then put those dollars into international equities, like shares, they would not have paid this tribute. (No one knows for sure why they didn’t, and it’s conceivable that the Russian and Chinese monetary authorities are not exactly sure themselves.) As it is, China and Russia are essentially underwriting a large part of the US military budget.

With enemies like that, who needs friends?

While the economics of seigniorage taxation is similar to what goes on in a Viking raid, the psychology is totally different. Suppose for example that the US military had invaded part of China, robbed it of $400 billion worth of stuff, and then left. Imagine the Chinese response! Instead what actually happened is that China effectively sent lots of stuff to the US in exchange for US dollars, after which the US government (via the Fed) simply printed more dollars so that the value of Chinese dollar holdings dropped by $400 billion. The same outcome happens, in terms of who ends up paying and who ends up enjoying the goods, but the seigniorage tax method is a lot more opaque, so the Chinese feel less cheated.

And in case you were wondering, the Americans’ foreign reserves are a pittance compared to other countries’, and few countries (including the US) hold significant quantities of Chinese yuan. Most of the 40 percent of foreign reserves that aren’t in US dollar-denominated assets are in euros, pounds, or yen.

How dependent on this is America?

US GDP is about $23 trillion per year in the period covered in our table, while total federal government spending is around $7 trillion per year. So, if we include the Eurodollar market, foreign tributes have been worth almost 8 percent of GDP per year, or 25 percent of US government spending per year. This means that the US economy would crash spectacularly next year if these tributes were to come to an end. Without the tributes, the US government would have to increase taxes by as much as 25 percent, or axe an amount of spending equivalent to the entire US military (plus change), or find another way to cut spending 25 percent. It is hard to see the Biden administration surviving that kind of dramatic policy change.

It is difficult to overestimate the importance of these tributary payments for US foreign policy and hence for current economic stability. In essence, in the table we see both the payoff to American military and economic dominance, and America’s own dependence on that payoff. The tributes permit America’s continued hold over the SWIFT system of interbank transactions, the petrodollars, the international financial institutions, and various other systems and levers of power. The size of the tributes also reveals the dependence of the whole system on them.

When students ask us what the point is of having 800 US military bases abroad, we point out to them how many of those bases are in countries that have large US dollar-denominated reserves. US military bases are plentiful in Japan, South Korea, and Saudi Arabia, all three of which make the top-10 list of tribute-payers. Of course, those military bases are purportedly there to provide local protection, but just as the mafia runs a protection racket in exchange for “contributions” from the protected, so too do those countries pay the US a hefty fee, via their US currency reserves, for the privilege of being protected.

As a form of implicit taxation, these tributes are very similar to using the WHO to force other countries into buying useless vaccines or to force allies to accept the tax evasion of big US companies.

Without seigniorage tax tributes, much of the American house of cards would collapse. Mass unemployment and huge civil strife would break out, at least in the short run. One could argue that the US economy and the US government have become diseased systems only struggling to remain afloat via the tributes paid by the rest of the world, supported by the financial ignorance of enemies.

This confronts well-meaning US politicians with a huge dilemma. Would they actually want to dismantle this system of parasitic big government and big corporations who, as an alliance, keep the tributes flowing in on which not just themselves, but everyone in the whole system depends? Dismantle the system and tens of millions of jobs will be lost. A housing crash. International humiliation.

Pause to think the next time you read about US involvement in a war in Europe, or a skirmish in the Middle East. Is it really about freedom, peace, and justice, or is it to keep the “American way” of tributes flowing? And, if you think about it, would you really want Donald Trump, Robert Kennedy, Jr, or Ron DeSantis to put an end to this? Do you want the US to plunge into an immediate and deep recession?

Published under a Creative Commons Attribution 4.0 International License

For reprints, please set the canonical link back to the original Brownstone Institute Article and Author.